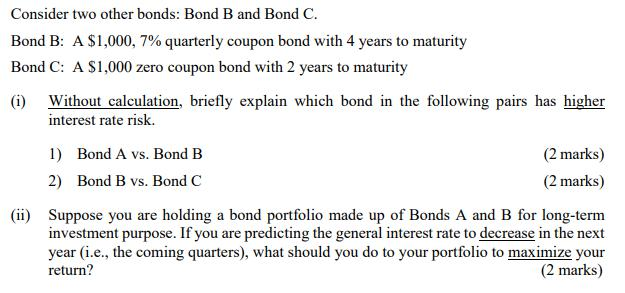

Question: 7 Consider two other bonds: Bond B and Bond C. Bond B: A $1,000, 7% quarterly coupon bond with 4 years to maturity Bond C:

7

Consider two other bonds: Bond B and Bond C. Bond B: A $1,000, 7% quarterly coupon bond with 4 years to maturity Bond C: A $1,000 zero coupon bond with 2 years to maturity (1) Without calculation, briefly explain which bond in the following pairs has higher interest rate risk. 1) Bond A vs. Bond B (2 marks) 2) Bond B vs. Bond C (2 marks) (ii) Suppose you are holding a bond portfolio made up of Bonds A and B for long-term investment purpose. If you are predicting the general interest rate to decrease in the next year (i.e., the coming quarters), what should you do to your portfolio to maximize your return? (2 marks) Consider two other bonds: Bond B and Bond C. Bond B: A $1,000, 7% quarterly coupon bond with 4 years to maturity Bond C: A $1,000 zero coupon bond with 2 years to maturity (1) Without calculation, briefly explain which bond in the following pairs has higher interest rate risk. 1) Bond A vs. Bond B (2 marks) 2) Bond B vs. Bond C (2 marks) (ii) Suppose you are holding a bond portfolio made up of Bonds A and B for long-term investment purpose. If you are predicting the general interest rate to decrease in the next year (i.e., the coming quarters), what should you do to your portfolio to maximize your return? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts