Question: 7. Corp Suite is considering two expansion options, but does not have enough capital to undertake both. Project W requires an investment of $100,000 and

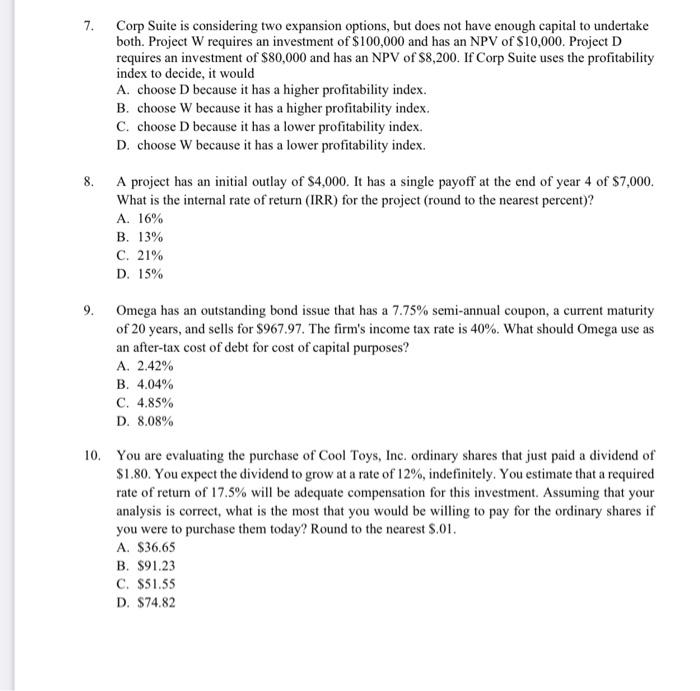

7. Corp Suite is considering two expansion options, but does not have enough capital to undertake both. Project W requires an investment of $100,000 and has an NPV of $10,000. Project D requires an investment of $80,000 and has an NPV of $8,200. If Corp Suite uses the profitability index to decide, it would A. choose D because it has a higher profitability index. B. choose W because it has a higher profitability index. C. choose D because it has a lower profitability index. D. choose W because it has a lower profitability index. A project has an initial outlay of $4,000. It has a single payoff at the end of year 4 of $7,000. What is the internal rate of return (IRR) for the project (round to the nearest percent)? A. 16% B. 13% C. 21% D. 15% 8. 9. Omega has an outstanding bond issue that has a 7.75% semi-annual coupon, a current maturity of 20 years, and sells for $967.97. The firm's income tax rate is 40%. What should Omega use as an after-tax cost of debt for cost of capital purposes? A. 2.42% B. 4.04% C. 4.85% D. 8.08% 10. You are evaluating the purchase of Cool Toys, Inc. ordinary shares that just paid a dividend of $1.80. You expect the dividend to grow at a rate of 12%, indefinitely. You estimate that a required rate of return of 17.5% will be adequate compensation for this investment. Assuming that your analysis is correct, what is the most that you would be willing to pay for the ordinary shares if you were to purchase them today? Round to the nearest S.01. A. $36.65 B. $91.23 C. $51.55 D. $74.82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts