Question: 7 different problems would like to be answered in respective order please and thank you entSessionLoc eBook Show Me How Calculator High-Low Method The manufacturing

7 different problems would like to be answered in respective order please and thank you

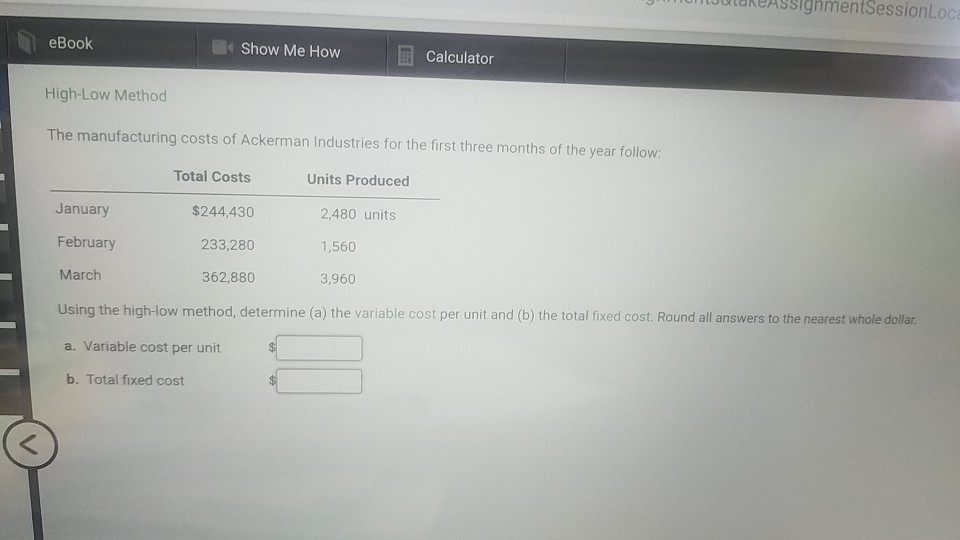

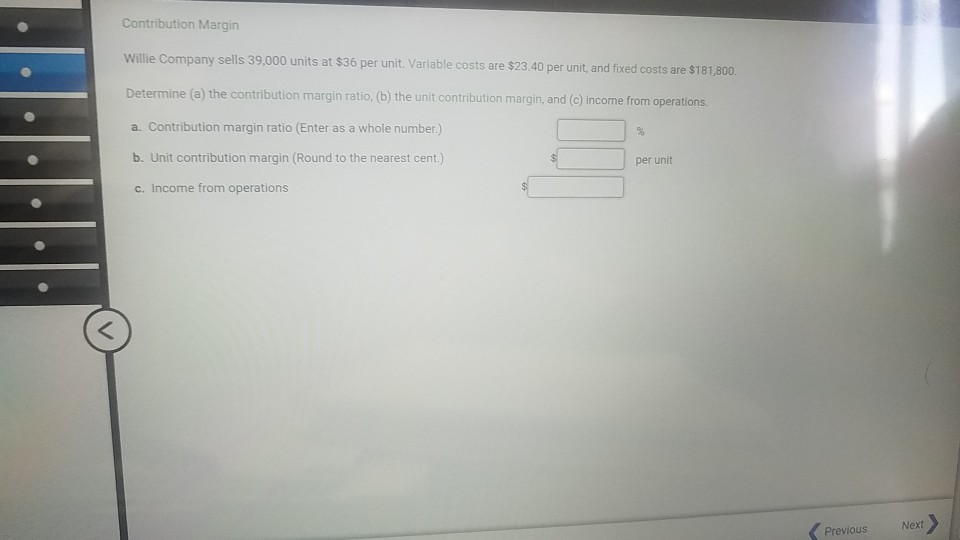

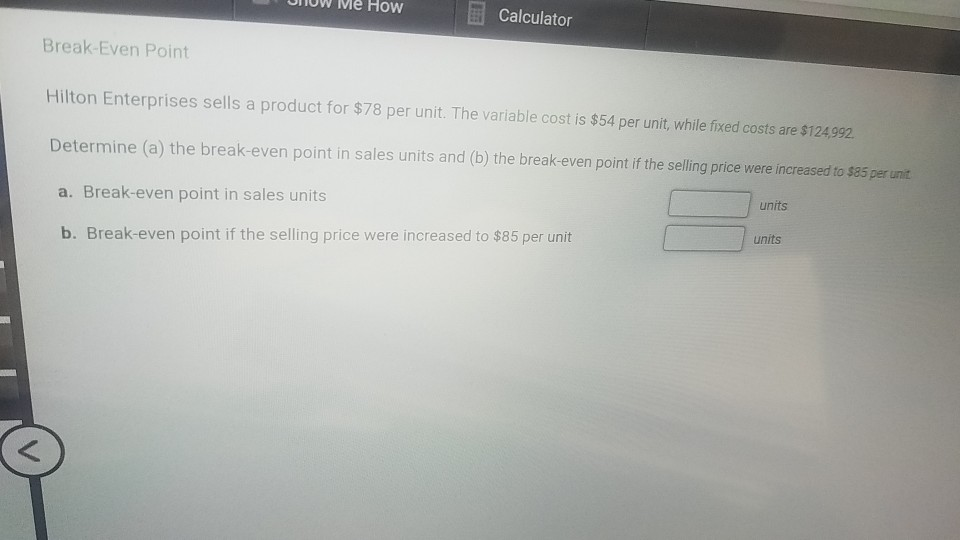

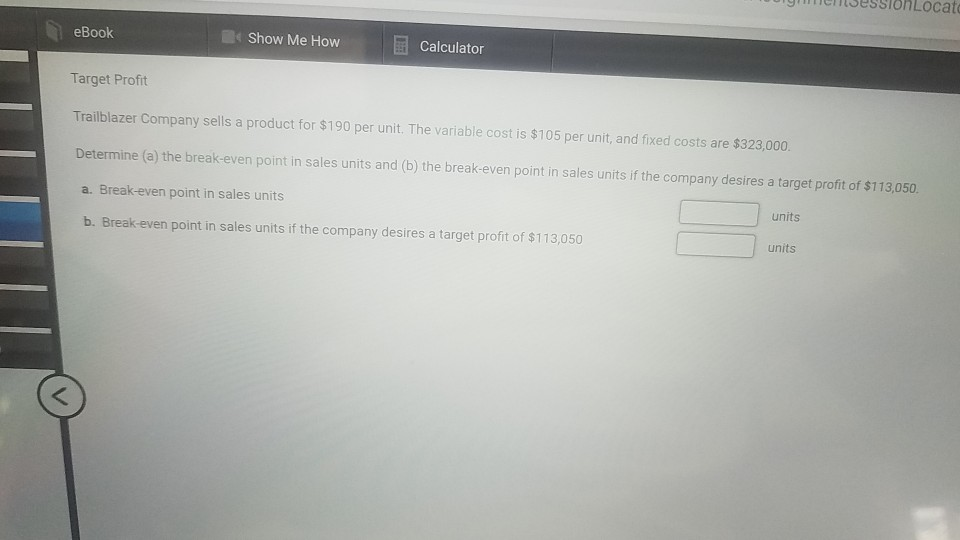

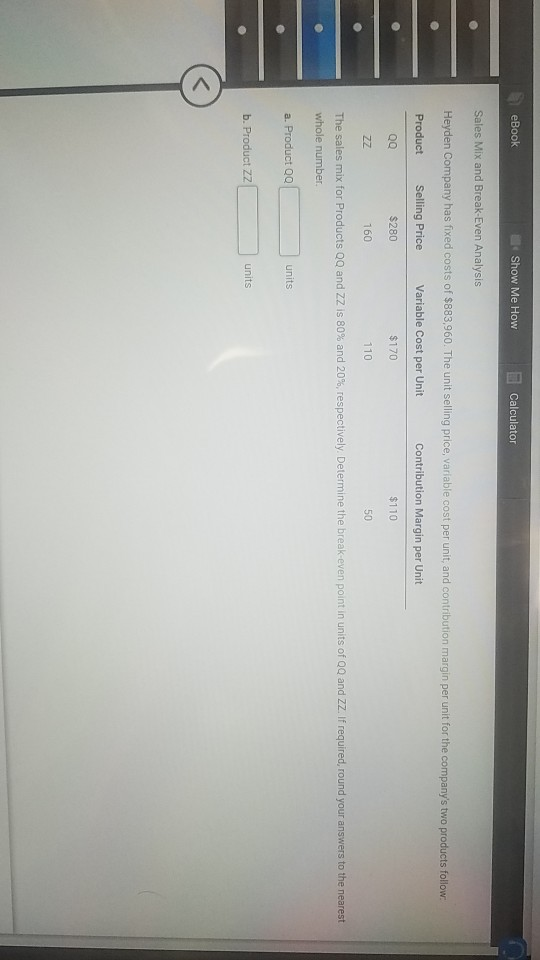

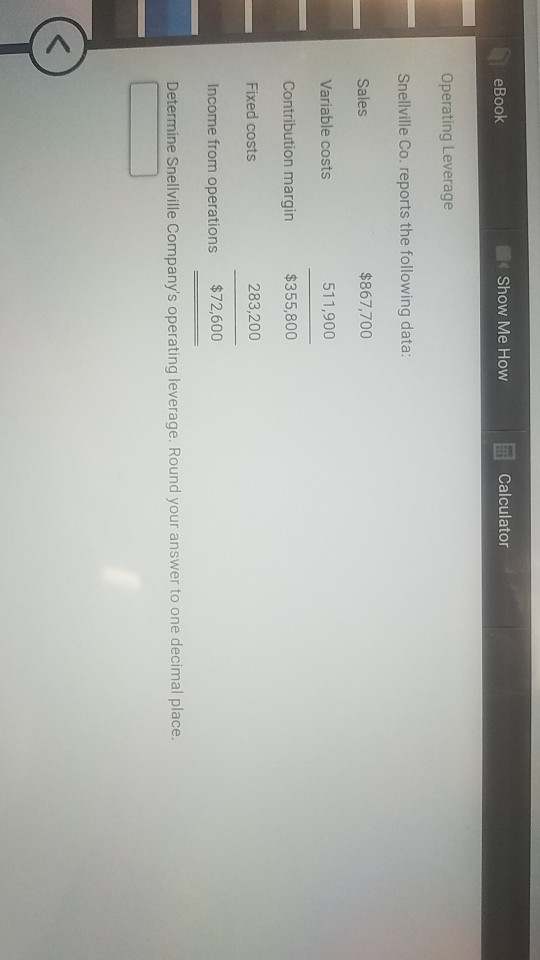

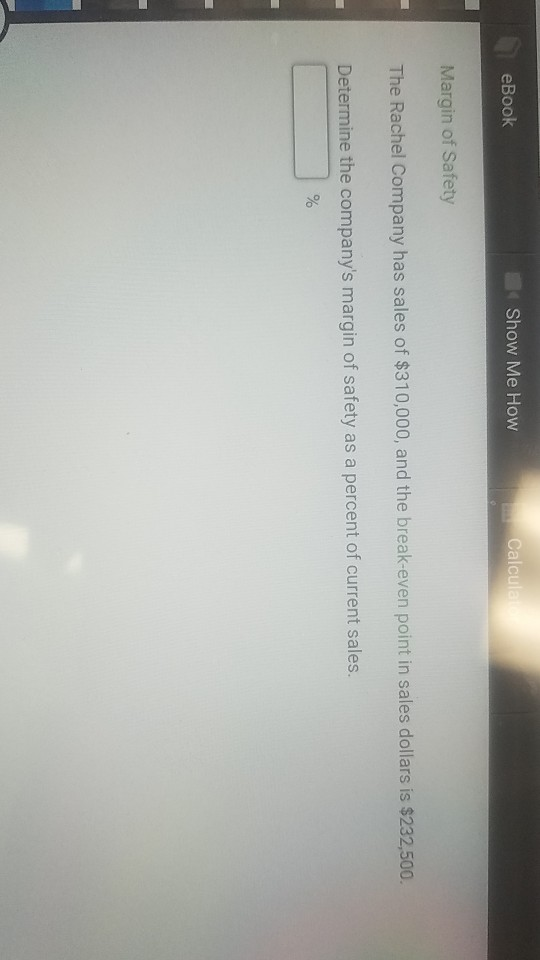

entSessionLoc eBook Show Me How Calculator High-Low Method The manufacturing costs of Ackerman Industries for the first three months of the year follow Total Costs Units Produced January $244,430 2,480 units 1,560 February 233,280 3,960 March 362,880 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. Round all answers to the nearest whole dollar a. Variable cost per unit b. Total fixed cost Contribution Margin Willie Company sells 39,000 units at $36 per unit. Variable costs are $23.40 per unit, and fixed costs are $181,800 Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) income from operations. a. Contribution margin ratio (Enter as a whole number.) 9% b. Unit contribution margin (Round to the nearest cent.) per unit c. Income from operations Next Previous e How Calculator Break-Even Point Hilton Enterprises sells a product for $78 per unit. The variable cost is $54 per unit, while fixed costs are $124992 Determine (a) the break-even point in sales units and (b) the break-even point if the selling price were increased to $85 per unit units a. Break-even point in sales units units b. Break-even point if the selling price were increased to $85 per unit ocat eBook Show Me How Calculator Target Profit Trailblazer Company sells a product for $190 per unit. The variable cost is $105 per unit, and fixed costs are $323,000. Determine (a) the break-even point in sales units and (b) the break-even point in sales units if the company desires a target profit of $113,050 a. Break-even point in sales units units b. Break-even point in sales units if the company desires a target profit of $113,050 units eBook |e Show Me How Calculator Sales Mix and Break-Even Analysis Heyden Company has fixed costs of $883,960. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow Product Selling Price Variable Cost per Unit Contribution Margin per Unit QQ $280 $170 $110 ZZ 160 110 50 The sales mix for Products 0Q and ZZ is 80% and 20% , respectively. Determine the break-even point in units of QQ and ZZ. If required, round your answers to the nearest whole number a. Product QQ units b. Product ZZ units eBook Show Me How Calculator Operating Leverage Snellville Co. reports the following data: Sales $867,700 Variable costs 511,900 Contribution margin $355,800 Fixed costs 283,200 Income from operations $72,600 Determine Snellville Company's operating leverage. Round your answer to one decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts