Question: 7) Future Value/Present value: A student takes an education loan from a bank. He expects to borrow $40,000 a year for the next 4 years

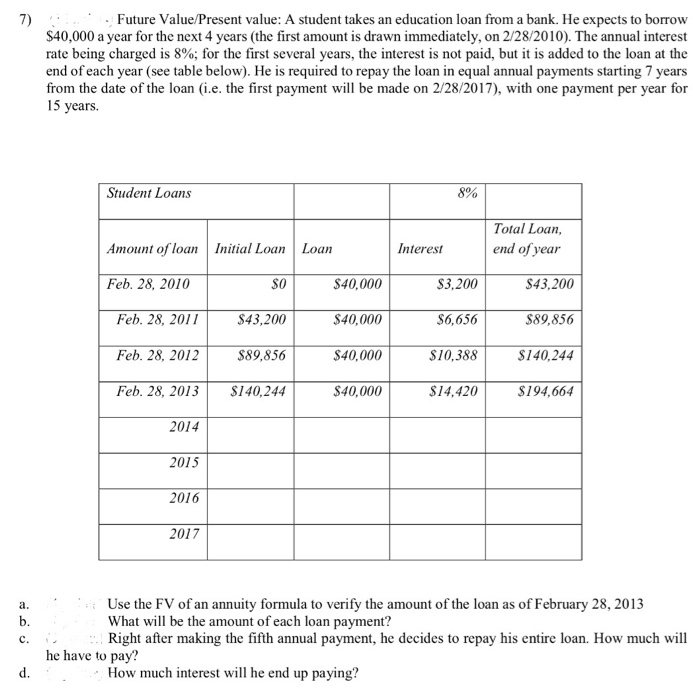

7) Future Value/Present value: A student takes an education loan from a bank. He expects to borrow $40,000 a year for the next 4 years (the first amount is drawn immediately, on 2/28/2010). The annual interest rate being charged is 8%; for the first several years, the interest is not paid, but it is added to the loan at the end of each year (see table below). He is required to repay the loan in equal annual payments starting 7 years from the date of the loan i.e. the first payment will be made on 2/28/2017), with one payment per year for 15 years. Student Loans 8% Total Loan Amount of loanInitial Loan Loan Interest end of year Feb. 28, 2010 S0 $43,200 $89,856 Feb. 28, 2013$140,244 S40,000 $40,000 $40,000 $40,000 S3,200 S6,656 $10,388 $14,420 $43,200 $89,856 $140,244 $194,664 Feb. 28, 2011 Feb. 28, 2012 2014 2015 2016 2017 Use the FV of an annuity formula to verify the amount of the loan as of February 28, 2013 What will be the amount of each loan payment? Right after making the fifth annual payment, he decides to repay his entire loan. How much will he have to pay? : How much interest will he end up paying

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts