Question: 7. Given that CFO is trying to become more efficient in these of working capital gak yow we advising the CFO in the are you

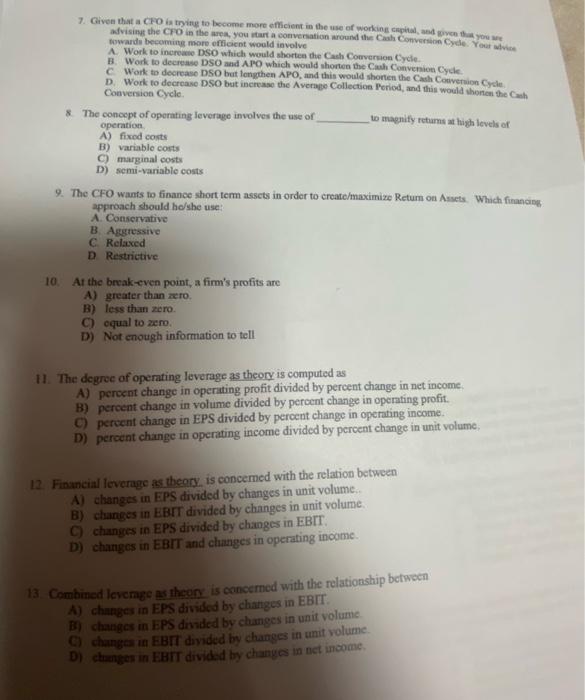

7. Given that CFO is trying to become more efficient in these of working capital gak yow we advising the CFO in the are you start a conversation around the Cash Conversion Cyde. You towards becoming more officient would involve A Work to incre DSO which would shorten the Cash Conversion Cycle B. Work to decrease DSO and APO which would shorten the Cash Convention Cycle C Work to decrease DSO but lengthen APO, and this would shorten the Cash Conversion Cycle D. Work to decrease DSO but increase the average Collection Period, and this would shorten the cash Conversion Cycle * The concept of operating leverage involves the use of to magnity returns at high levels of operation A) fixed costs B) variable costs C) marginal costs D) semi-variable costs 9. The CFO wants to finance short term assets in order to create/maximize Retum on Amets Which financing approach should he/she use A. Conservative B. Aggress C Relaxed D Restrictive 10 At the break-even point, a firm's profits are A) greater than zero B) less than zero C) equal to zero D) Not enough information to tell 11. The degree of operating leverage as theory is computed as A) percent change in operating profit divided by percent change in net income B) percent change in volume divided by percent change in operating profit. C) percent change in EPS divided by percent change in operating income D) percent change in operating income divided by percent change in unit volume 12. Financial leverage as theory is concerned with the relation between A) changes in EPS divided by changes in unit volume.. B) changes in EBIT divided by changes in unit volume changes in EPS divided by changes in EBIT. D) changes in EBIT and changes in operating income 13. Combined levenge as there is concerned with the relationship between A) changes in EPS divided by changes in EBIT B) changes in EPS divided by changes in unit volume changes in EBIT divided by changes in unit volume D) changes in EBIT divided by changes in net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts