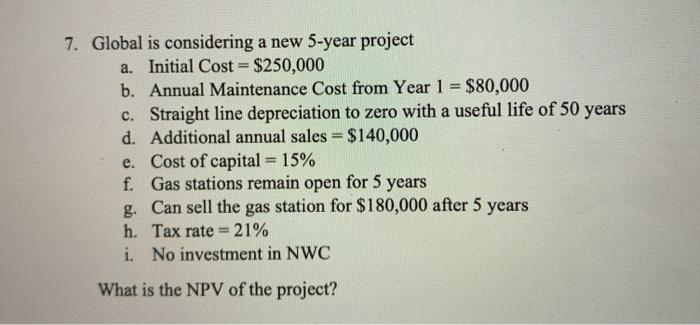

Question: 7. Global is considering a new 5-year project a. Initial Cost = $250,000 b. Annual Maintenance Cost from Year 1 = $80,000 c. Straight line

7. Global is considering a new 5-year project a. Initial Cost = $250,000 b. Annual Maintenance Cost from Year 1 = $80,000 c. Straight line depreciation to zero with a useful life of 50 years d. Additional annual sales = $140,000 e. Cost of capital = 15% f. Gas stations remain open for 5 years g. Can sell the gas station for $180,000 after 5 years h. Tax rate=21% i. No investment in NWC What is the NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts