Question: 7 . hCHAPTER 1 4 : CAPITAL BUDGETING Homework Problem 4 . 7 Assume that you are the COO at Cactus Valley Medical Center. The

hCHAPTER : CAPITAL BUDGETING

Homework Problem

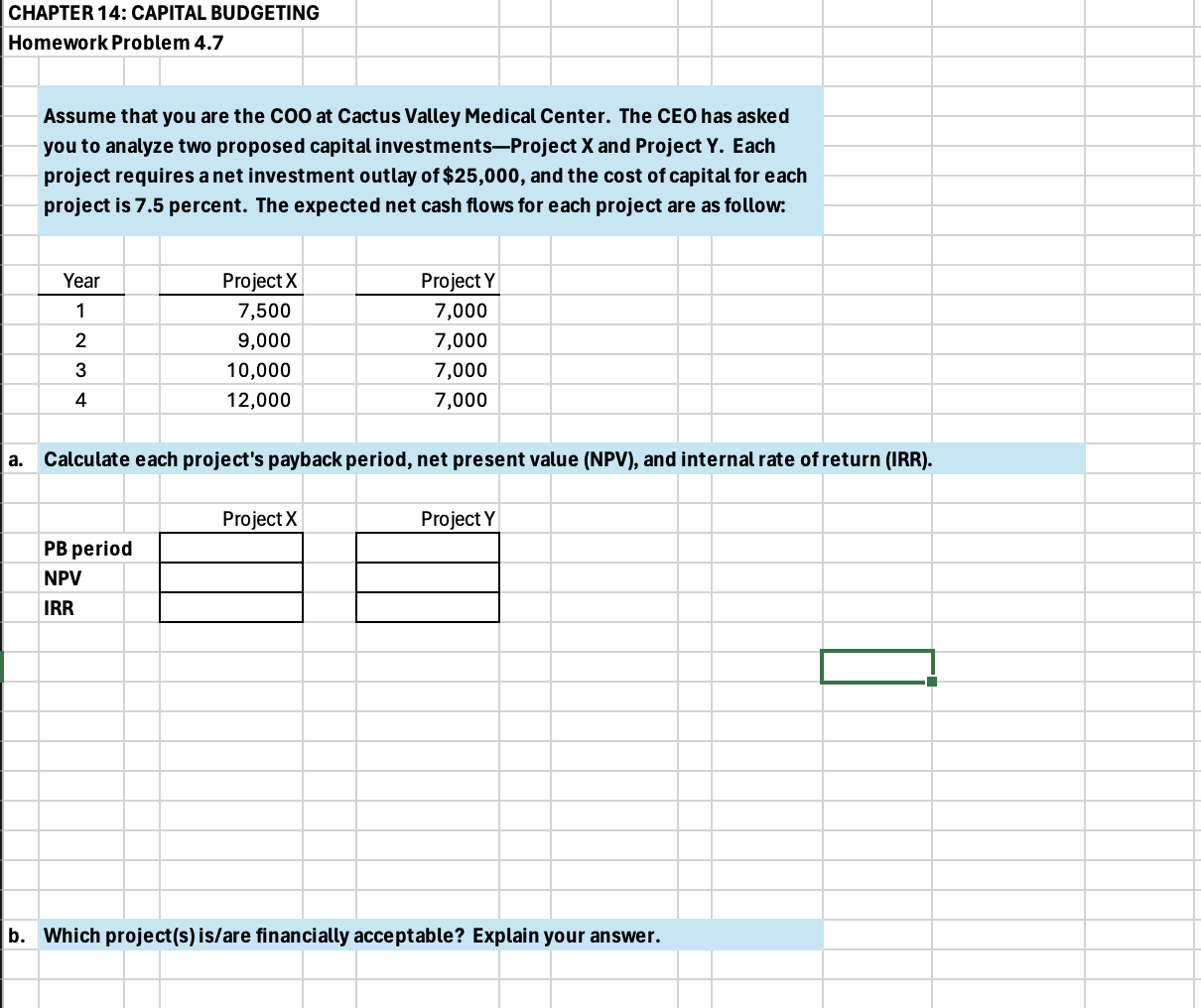

Assume that you are the COO at Cactus Valley Medical Center. The CEO has asked

you to analyze two proposed capital investmentsProject and Project Y Each

project requires a net investment outlay of $ and the cost of capital for each

project is percent. The expected net cash flows for each project are as follow:

a Calculate each project's payback period, net present value NPV and internal rate of return IRR

b Which projects isare financially acceptable? Explain your answer.

help solve these questions, with steps on how to use it with inputting the formulas into Excel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock