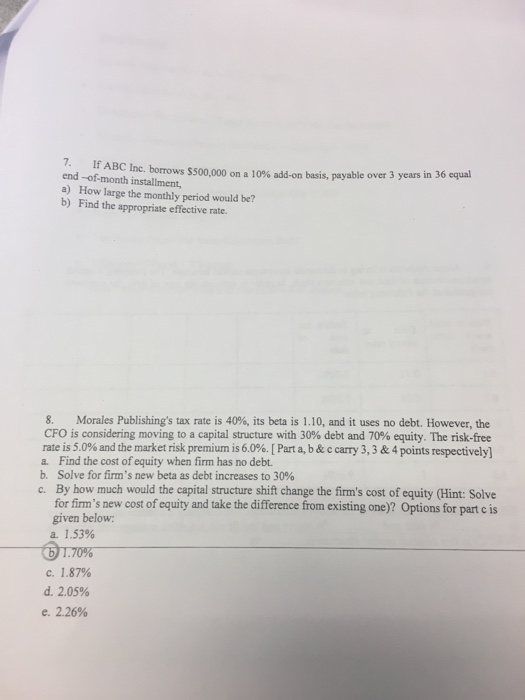

Question: 7- If ABC Inc. borrows $500,000 on a 10% add-on basis, payable end -of-month installment, a) How large the monthly period would be? b) Find

7- If ABC Inc. borrows $500,000 on a 10% add-on basis, payable end -of-month installment, a) How large the monthly period would be? b) Find the appropriate effective rate. over 3 years in 36 equal 8, Morales Publishing's tax rate is 40%, its beta is 1.10, and it uses no debt. However, the CFO is considering moving to a capital structure with 30% debt and 70% equity. The risk-free rate is 5.0% and the market risk premium is 6.0%. [ Part a, b & c carry 3, 3 & 4 points respectively] Find the cost of equity when firm has no debt. b. Solve for firm's new beta as debt increases to 30% c. By how much would the capital structure shift change the firm's cost of equity (Hint: Solve for firm's new cost of equity and take the difference from existing one)? Options for part c is given below a. 1.53% T70% c. 1.87% d. 2.05% e. 2.26%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts