Question: 7. If project A has a lower payback period than project B, this may indicate that project A may have a A) lower NPV

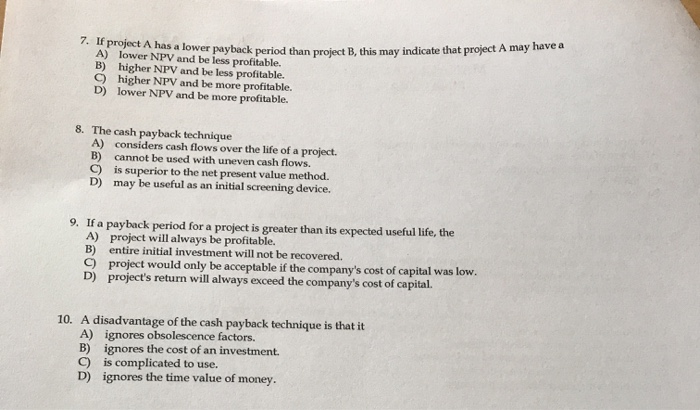

7. If project A has a lower payback period than project B, this may indicate that project A may have a A) lower NPV and be less profitable. higher NPV and be less profitable. higher NPV and be more profitable. D) lower NPV and be more profitable. B) C) 8. The cash payback technique A) B) C) D) considers cash flows over the life of a project. cannot be used with uneven cash flows. is superior to the net present value method. may be useful as an initial screening device. 9. If a payback period for a project is greater than its expected useful life, the A) project will always be profitable. B) entire initial investment will not be recovered. C) project would only be acceptable if the company's cost of capital was low. D) project's return will always exceed the company's cost of capital. 10. A disadvantage of the cash payback technique is that it A) ignores obsolescence factors. B) ignores the cost of an investment. C) is complicated to use. D) ignores the time value of money.

Step by Step Solution

There are 3 Steps involved in it

7 Pay back period is the time required for a project to return its investment The shorter the paybac... View full answer

Get step-by-step solutions from verified subject matter experts