Question: 7) Ir all publicly available information is reflected in current security prices (but not all private information), the market is (a) strongly efficient (b) weakly

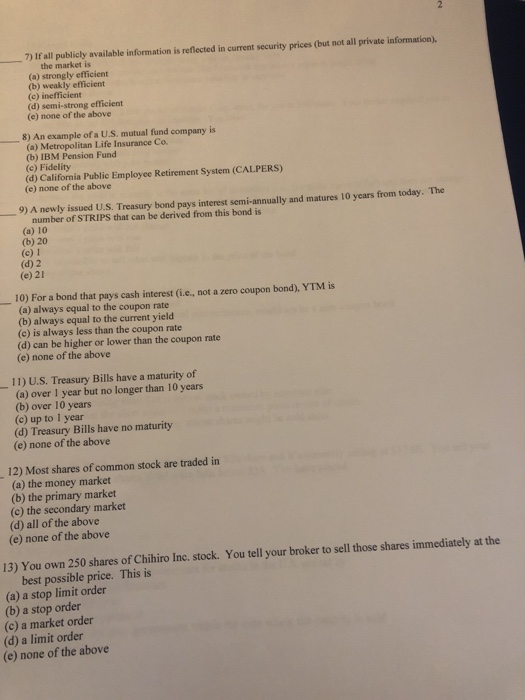

7) Ir all publicly available information is reflected in current security prices (but not all private information), the market is (a) strongly efficient (b) weakly efficient (c) inefficient (d) semi-strong efficient (e) none of the above 8) An example of a U.S. mutual fund company is (a) Metropolitan Life Insurance Co. (b) IBM Pension Fund (c) Fidelity (d) California Public Employee Retirement System (CALPERS) (e) none of the above 9) A newly issued U.S. Treasury bond pays interest semi-annually and matures 10 years from today. The number of STRIPS that can be derived from this bond is (a) 10 (b) 20 (c) 1 (d) 2 (e) 21 10) For a bond that pays cash interest (ie, not a zero coupon bond), YTM is (a) always equal to the coupon rate (b) always equal to the current yield (c) is always less than the coupon rate (d) can be higher or lower than the coupon rate (e) none of the above 11) U.S. Treasury Bills have a maturity of (a) over 1 year but no longer than 10 years (b) over 10 years (c) up to 1 year (d) Treasury Bills have no maturity (e) none of the above 12) Most shares of common stock are traded in (a) the money market (b) the primary market (c) the secondary market (d) all of the above (e) none of the above 13) You own 250 shares of Chihiro Inc, stock. You tell your broker to sell those shares immediately at the best possible price. This is (a) a stop limit order (b) a stop order (c) a market order (d) a limit order (e) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts