Question: 7. Let us consider the relationship between the natural logarithm of GDP, GDP, and the lagged long-term interest rates ratet, and ratet-1. (a) Assume that

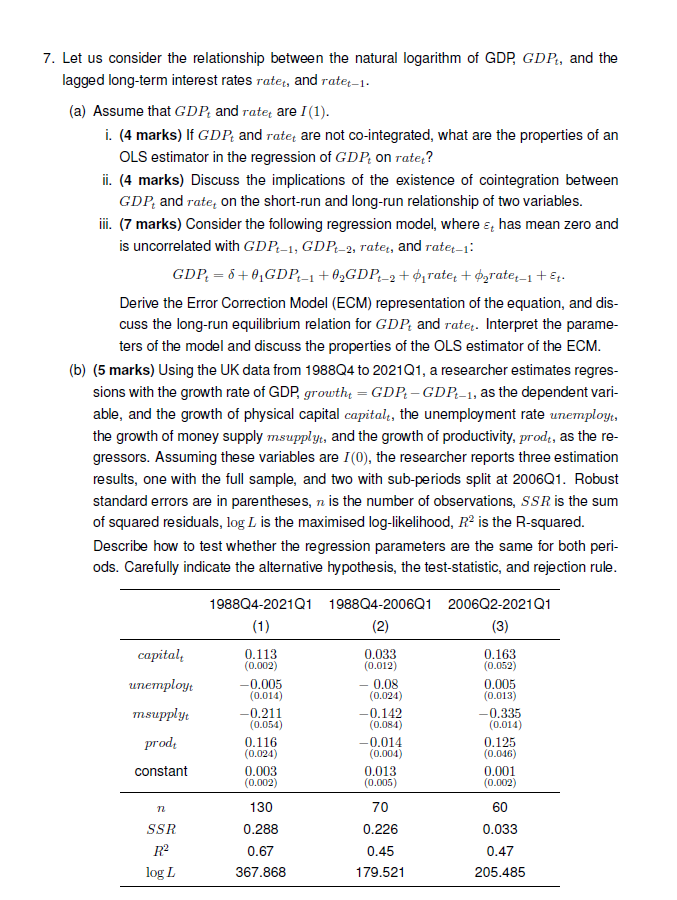

7. Let us consider the relationship between the natural logarithm of GDP, GDP, and the lagged long-term interest rates ratet, and ratet-1. (a) Assume that GDP and rate are I (1). i. (4 marks) If GDP and rate are not co-integrated, what are the properties of an OLS estimator in the regression of GDP on rate? ii. (4 marks) Discuss the implications of the existence of cointegration between GDP, and rate, on the short-run and long-run relationship of two variables. iii. (7 marks) Consider the following regression model, where has mean zero and is uncorrelated with GDP-1, GDP-2, ratet, and ratet-1: GDP, = 8+0,GDP-1 +8,GDP-2+$, ratet + $grate -1 +Ep. Derive the Error Correction Model (ECM) representation of the equation, and dis- cuss the long-run equilibrium relation for GDP, and ratet. Interpret the parame- ters of the model and discuss the properties of the OLS estimator of the ECM. (b) (5 marks) Using the UK data from 1988Q4 to 2021Q1, a researcher estimates regres- sions with the growth rate of GDP growth = GDP - GDP-1, as the dependent vari- able, and the growth of physical capital capitalt, the unemployment rate unemployt, the growth of money supply msupplyt, and the growth of productivity, prodt, as the re- gressors. Assuming these variables are I(C), the researcher reports three estimation results, one with the full sample, and two with sub-periods split at 2006Q1. Robust standard errors are in parentheses, n is the number of observations, SSR is the sum of squared residuals, log L is the maximised log-likelihood, R2 is the R-squared. Describe how to test whether the regression parameters are the same for both peri- ods. Carefully indicate the alternative hypothesis, the test-statistic, and rejection rule. 1988Q4-2021Q1 1988Q4-2006Q1 2006Q2-2021Q1 (1) (2) (3) capital 0.113 (0.002) 0.033 (0.012) 0.163 (0.052) unemployt - 0.08 (0.024) -0.005 (0.014) -0.211 (0.054) msupply 0.005 (0.013) -0.335 (0.014) 0.125 (0.046) 0.001 (0.002) prod -0.142 (0.084) -0.014 (0.004) 0.013 (0.005) 0.116 (0.024) 0.003 (0.002) constant n2 130 70 60 SSR 0.288 0.226 0.033 R2 0.67 0.45 0.47 log L 367.868 179.521 205.485 7. Let us consider the relationship between the natural logarithm of GDP, GDP, and the lagged long-term interest rates ratet, and ratet-1. (a) Assume that GDP and rate are I (1). i. (4 marks) If GDP and rate are not co-integrated, what are the properties of an OLS estimator in the regression of GDP on rate? ii. (4 marks) Discuss the implications of the existence of cointegration between GDP, and rate, on the short-run and long-run relationship of two variables. iii. (7 marks) Consider the following regression model, where has mean zero and is uncorrelated with GDP-1, GDP-2, ratet, and ratet-1: GDP, = 8+0,GDP-1 +8,GDP-2+$, ratet + $grate -1 +Ep. Derive the Error Correction Model (ECM) representation of the equation, and dis- cuss the long-run equilibrium relation for GDP, and ratet. Interpret the parame- ters of the model and discuss the properties of the OLS estimator of the ECM. (b) (5 marks) Using the UK data from 1988Q4 to 2021Q1, a researcher estimates regres- sions with the growth rate of GDP growth = GDP - GDP-1, as the dependent vari- able, and the growth of physical capital capitalt, the unemployment rate unemployt, the growth of money supply msupplyt, and the growth of productivity, prodt, as the re- gressors. Assuming these variables are I(C), the researcher reports three estimation results, one with the full sample, and two with sub-periods split at 2006Q1. Robust standard errors are in parentheses, n is the number of observations, SSR is the sum of squared residuals, log L is the maximised log-likelihood, R2 is the R-squared. Describe how to test whether the regression parameters are the same for both peri- ods. Carefully indicate the alternative hypothesis, the test-statistic, and rejection rule. 1988Q4-2021Q1 1988Q4-2006Q1 2006Q2-2021Q1 (1) (2) (3) capital 0.113 (0.002) 0.033 (0.012) 0.163 (0.052) unemployt - 0.08 (0.024) -0.005 (0.014) -0.211 (0.054) msupply 0.005 (0.013) -0.335 (0.014) 0.125 (0.046) 0.001 (0.002) prod -0.142 (0.084) -0.014 (0.004) 0.013 (0.005) 0.116 (0.024) 0.003 (0.002) constant n2 130 70 60 SSR 0.288 0.226 0.033 R2 0.67 0.45 0.47 log L 367.868 179.521 205.485

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts