Question: 7. List three major differences between US GAAP accounting standards and IFRS accounting standards in the accounting for assets. a. b. c. 8. Catahoula Company

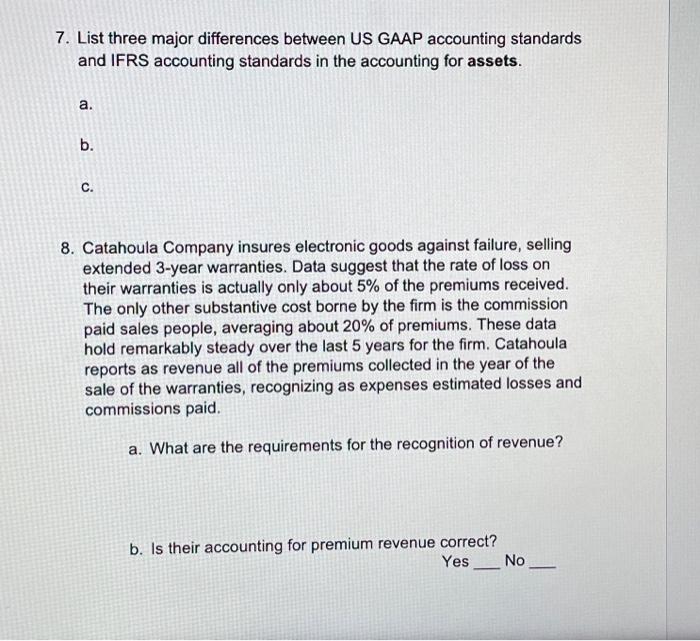

7. List three major differences between US GAAP accounting standards and IFRS accounting standards in the accounting for assets. a. b. c. 8. Catahoula Company insures electronic goods against failure, selling extended 3-year warranties. Data suggest that the rate of loss on their warranties is actually only about 5% of the premiums received. The only other substantive cost borne by the firm is the commission paid sales people, averaging about 20% of premiums. These data hold remarkably steady over the last 5 years for the firm. Catahoula reports as revenue all of the premiums collected in the year of the sale of the warranties, recognizing as expenses estimated losses and commissions paid. a. What are the requirements for the recognition of revenue? b. Is their accounting for premium revenue correct? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts