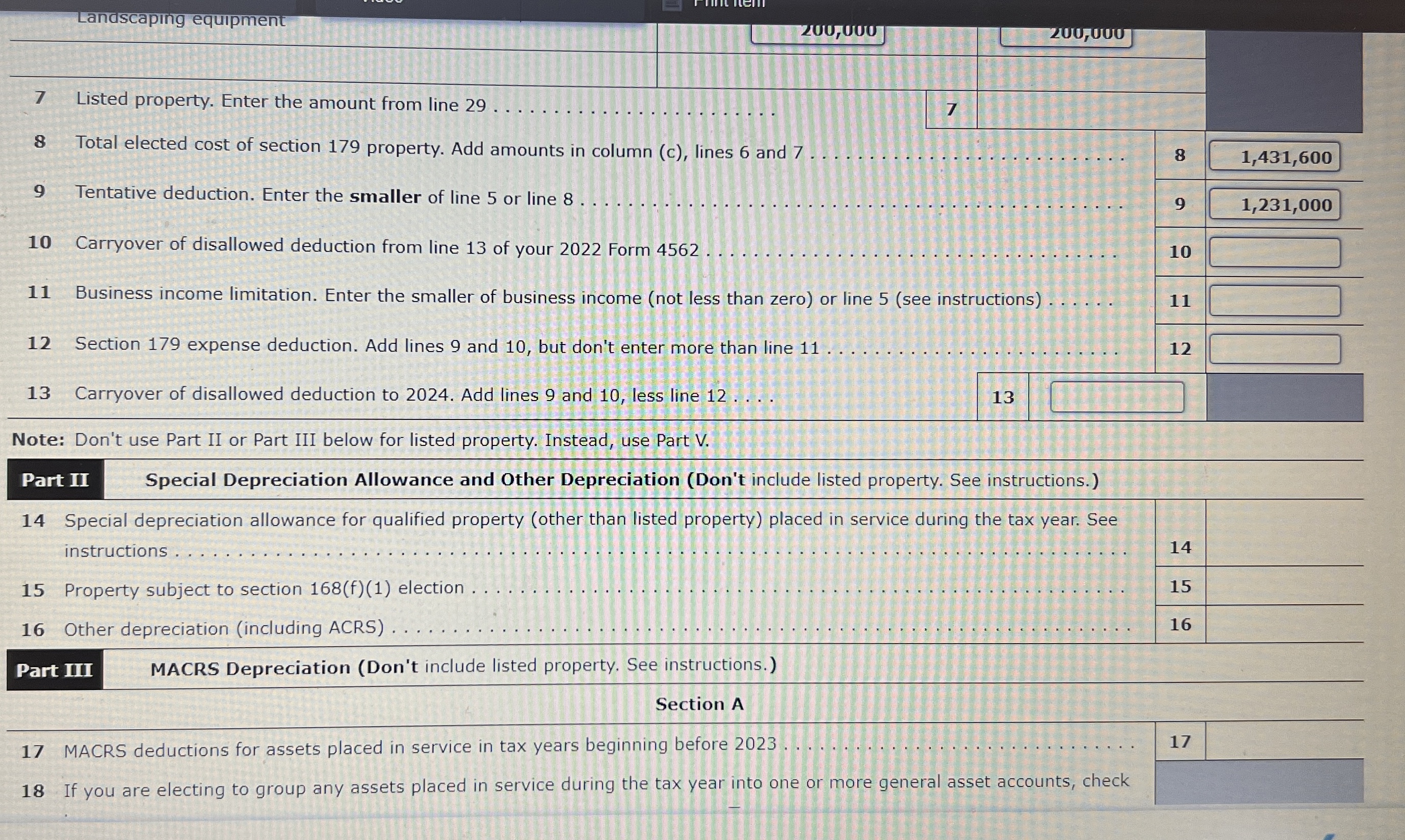

Question: 7 Listed property. Enter the amount from line 2 9 8 Total elected cost of section 1 7 9 property. Add amounts in column (

Listed property. Enter the amount from line

Total elected cost of section property. Add amounts in column c lines and

Tentative deduction. Enter the smaller of line or line

Business income limitation Enter the smaller of business income not less than zero or line see instructions

Section expense deduction. Add lines and but don't enter more than line

Carryover of disallowed deduction to Add lines and less line

Note: Don't use Part II or Part III below for listed property. Instead, use Part V

Part II Special Depreciation Allowance and Other Depreciation Dont include listed property. See instructions.

Special depreciation allowance for qualified property other than listed property placed in service during the tax year. See

instructions.

Property subject to section f election.

Other depreciation including ACRS

MACRS Depreciation Dont include listed property. See instructions.

Section A

MACRS deductions for assets placed in service in tax years beginning before

If you are electing to group any assets placed in service during the tax year into one or more general asset accounts, check

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock