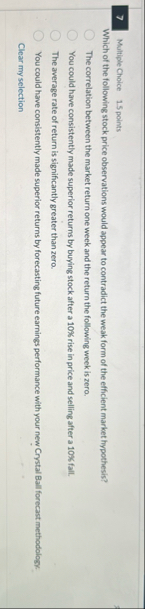

Question: 7 Multiple Choice 1 . 5 points Which of the following stock price observations would appear to contradict the weak form of the efficient market

Multiple Choice

points

Which of the following stock price observations would appear to contradict the weak form of the efficient market hypothesis?

The correlation between the market return one week and the return the following week is zero.

You could have consistently made superior returns by buying stock after a rise in price and selling after a fall.

The awerage rate of return is significantly greater than zero.

You could have consistently made superior returns by forecasting future earnings performance with your new Crystal Ball forecast methodology.

Clear my selection

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock