Question: 7 part question 3 part Integrative-Multiple leverage measures Play-More Toys produces inflatable beach balls, selling 350,000 balls per year, Each ball produced has a variable

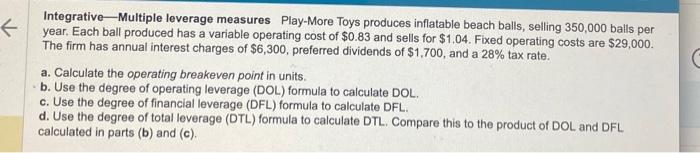

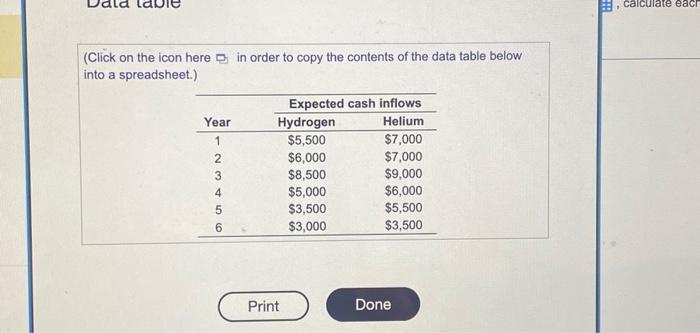

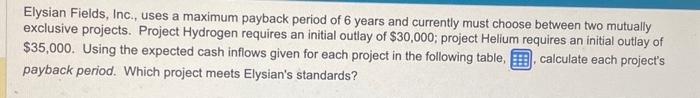

Integrative-Multiple leverage measures Play-More Toys produces inflatable beach balls, selling 350,000 balls per year, Each ball produced has a variable operating cost of $0.83 and sells for $1,04. Fixed operating costs are $29,000. The firm has annual interest charges of $6,300, preferred dividends of $1,700, and a 28% tax rate. a. Calculate the operating breakeven point in units. b. Use the degree of operating leverage (DOL) formula to calculate DOL. c. Use the degree of financial leverage (DFL) formula to calculate DFL. d. Use the degree of total leverage (DTL) formula to calculate DTL. Compare this to the product of DOL and DFL calculated in parts (b) and (c). (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $30,000; project Hellium requires an initial outlay of $35,000. Using the expected cash inflows given for each project in the following table, , calculate each project's payback period. Which project meets Elysian's standards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts