Question: 7. Peekskill Company sold a computer for $50,000. The computer's original cost was $250,000, and the accumulated depreciation at the date of sale was $180,000.

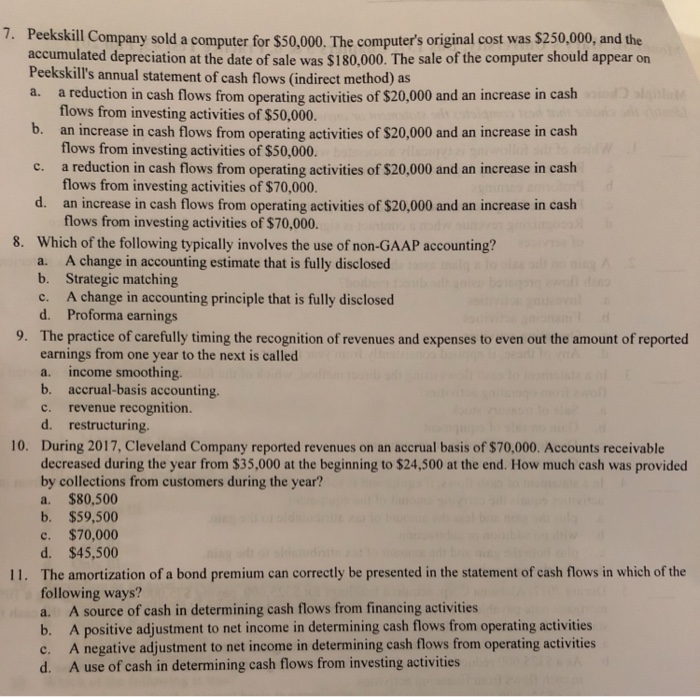

7. Peekskill Company sold a computer for $50,000. The computer's original cost was $250,000, and the accumulated depreciation at the date of sale was $180,000. The sale of the computer should appear on Peekskill's annual statement of cash flows (indirect method) as a. a reduction in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $50,000. b. an increase in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $50,000. a reduction in cash flows from operating activities of $20,000 and an increase in cash c. flows from investing activities of $70,000. d. an increase in cash flows from operating activities of $20,000 and an increase in cash flows from investing activities of $70,000. Which of the following typically involves the use of non-GAAP accounting? 8. a. A change in accounting estimate that is fully disclosed b. Strategic matching A change in accounting principle that is fully disclosed c. d. Proforma earnings The practice of carefully timing the recognition of revenues and expenses to even out the amount of reported earnings from one year to the next is called a. income smoothing b. accrual-basis accounting. c. revenue recognition. d. restructuring. During 2017, Cleveland Company reported revenues on an accrual basis of $70,000. Accounts receivable decreased during the year from $35,000 at the beginning to $24,500 at the end. How much cash was provided by collections from customers during the year? a. $80,500 b. $59,500 c. $70,000 d. $45,500 The amortization of a bond premium can correctly be presented in the statement of cash flows in which of the following ways? a. A source of cash in determining cash flows from financing activities b. A positive adjustment to net income in determining cash flows from operating activities c. A negative adjustment to net income in determining cash flows from operating activities d. A use of cash in determining cash flows from investing activities 9. 10. 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts