Question: #7 please answer all parts (fill in all boxes). please read the questionumbers carefully! similar questions may already be posted to Chegg but they have

#7 please answer all parts (fill in all boxes). please read the questionumbers carefully! similar questions may already be posted to Chegg but they have slightly different numbers. i will give upvote/thumbs up for correct answer! thank you for your help!

*if you give me an email and ask for money I will report you*

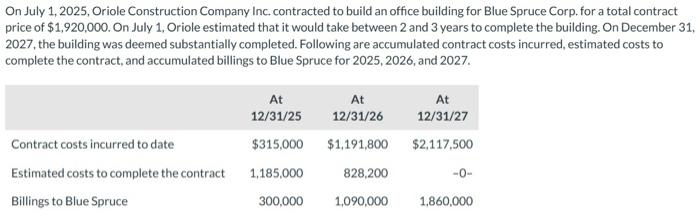

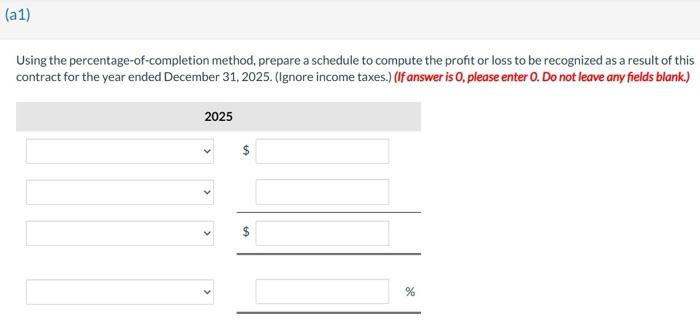

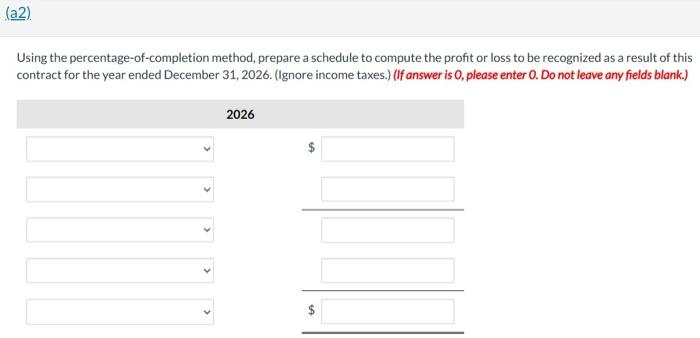

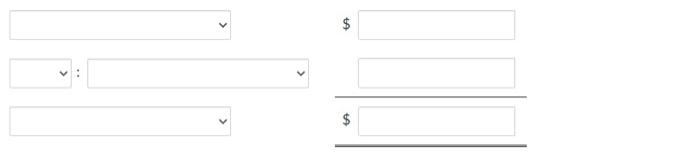

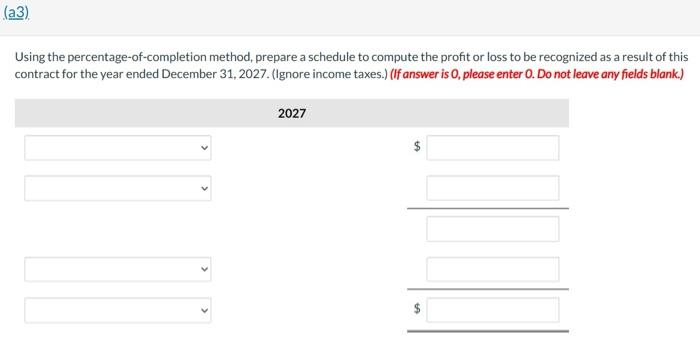

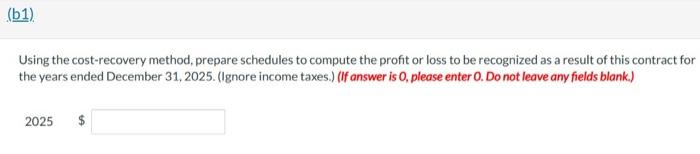

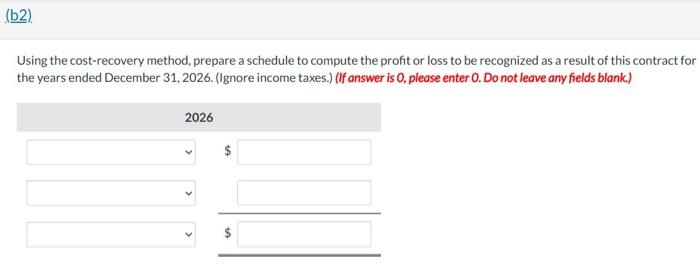

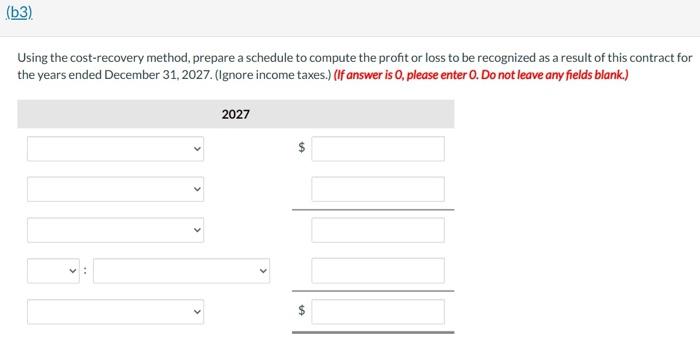

On July 1, 2025, Oriole Construction Company Inc. contracted to build an office building for Blue Spruce Corp. for a total contract price of $1,920,000. On July 1 , Oriole estimated that it would take between 2 and 3 years to complete the building. On December 31 , 2027 , the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Blue Spruce for 2025, 2026, and 2027. Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2025. (Ignore income taxes.) (If answer is 0, please enter 0. Do not leave any fields blank.) Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2026. (Ignore income taxes.) (If answer is 0, please enter 0. Do not leave any fields blank.) Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2027. (Ignore income taxes.) (If answer is 0 , please enter 0 . Do not leave any fields blank.) Using the cost-recovery method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2025. (Ignore income taxes.) (If answer is 0, please enter 0. Do not leave any fields blank.) 2025$ Using the cost-recovery method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2026. (Ignore income taxes.) (If answer is 0 , please enter 0 . Do not leave any fields blank.) Using the cost-recovery method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2027. (Ignore income taxes.) (If answer is 0, please enter 0. Do not leave any fields blank.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts