Question: 7.) Please answer with Excel formula A B D E F G H I J K 1 2 3 A Japanese company has a bond

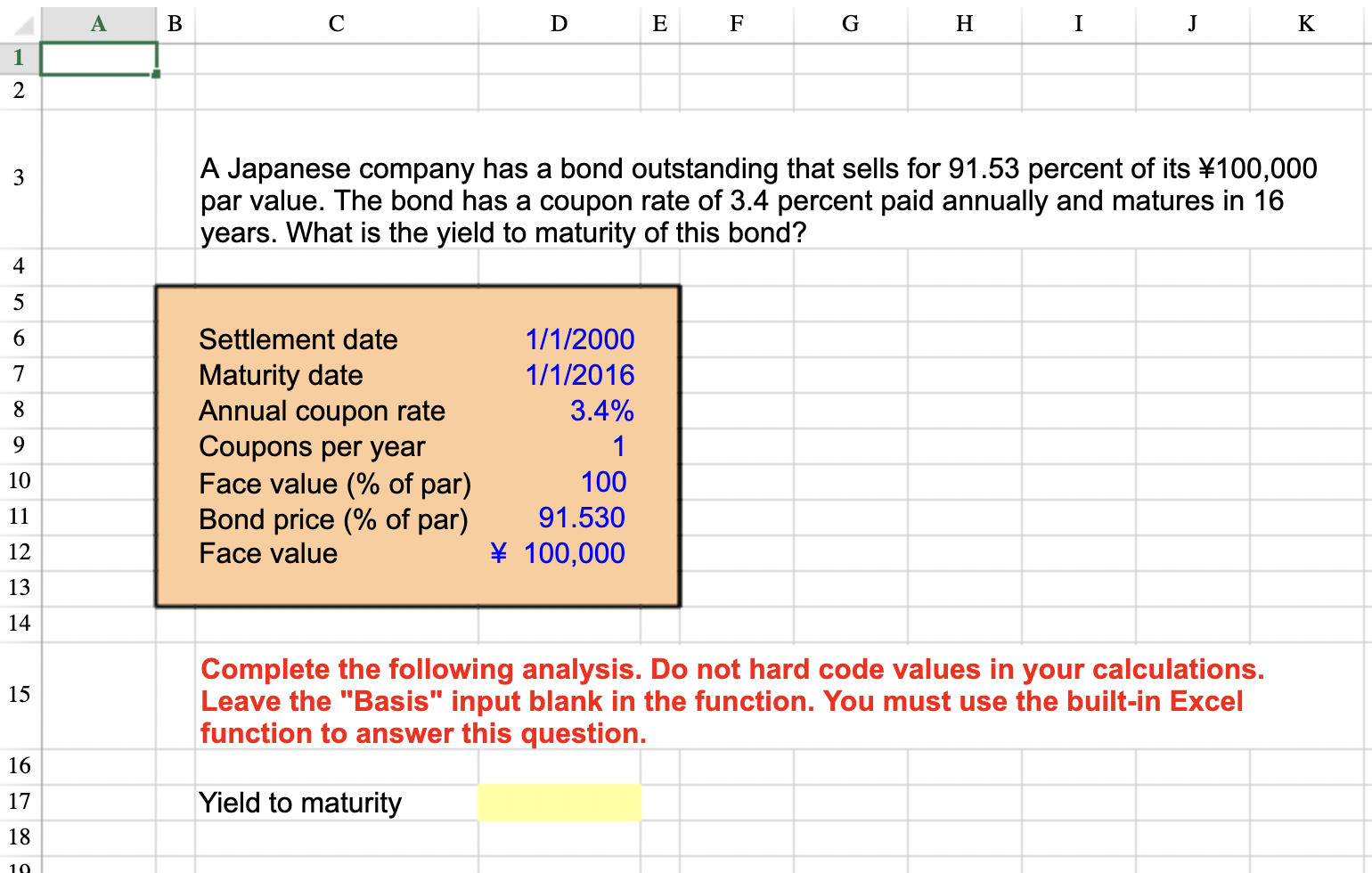

7.) Please answer with Excel formula

A B D E F G H I J K 1 2 3 A Japanese company has a bond outstanding that sells for 91.53 percent of its 100,000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? 4 5 6 7 8 9 Settlement date Maturity date Annual coupon rate Coupons per year Face value (% of par) Bond price (% of par) Face value 1/1/2000 1/1/2016 3.4% 1 100 91.530 \ 100,000 10 11 12 13 14 15 Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the function. You must use the built-in Excel function to answer this question. 16 17 Yield to maturity 18 8 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts