Question: 7 points (One-half point each numbered question mark) The following information was pulled from McElroy Local Airline's general ledger for the year just ended. A

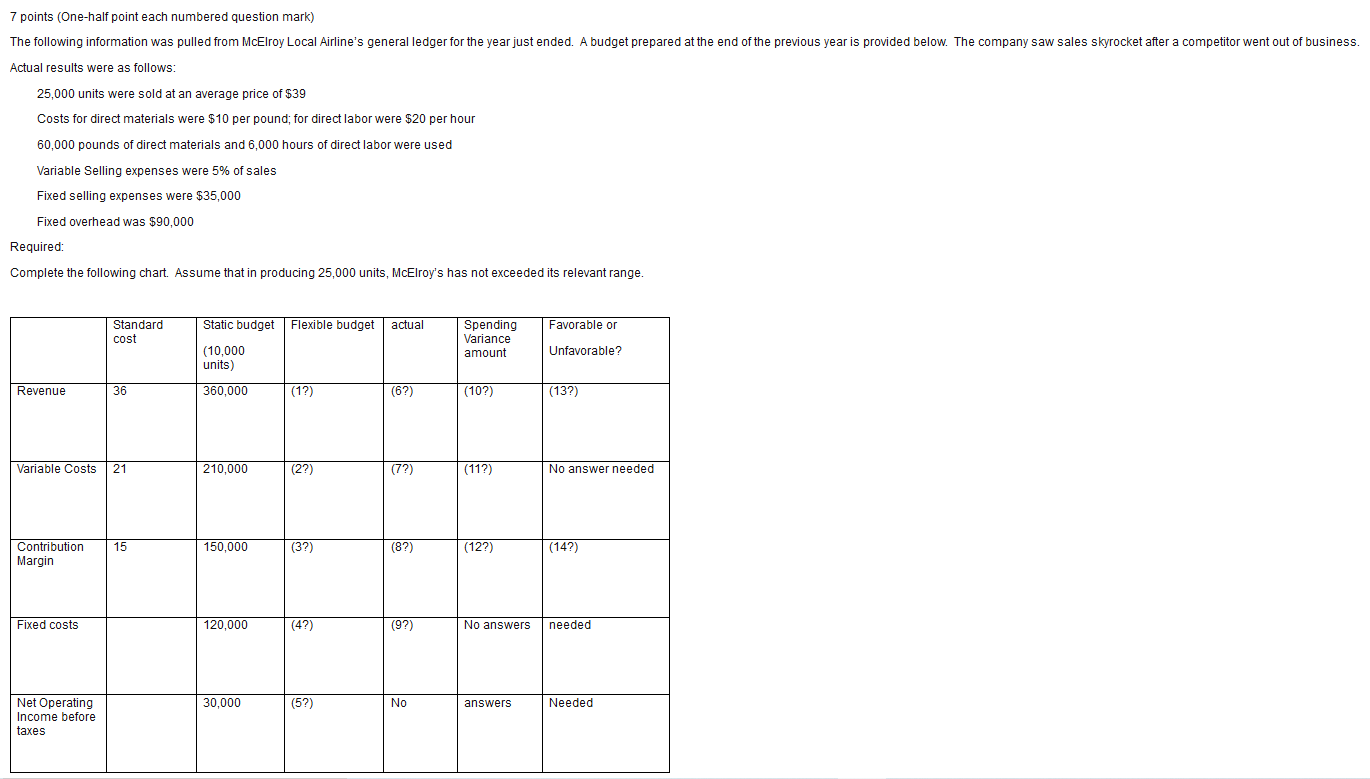

7 points (One-half point each numbered question mark) The following information was pulled from McElroy Local Airline's general ledger for the year just ended. A budget prepared at the end of the previous year is provided below. The company saw sales skyrocket after a competitor went out of business. Actual results were as follows: 25,000 units were sold at an average price of $39 Costs for direct materials were $10 per pound; for direct labor were $20 per hour 60,000 pounds of direct materials and 6,000 hours of direct labor were used Variable Selling expenses were 5% of sales Fixed selling expenses were $35,000 Fixed overhead was $90,000 Required: Complete the following chart. Assume that in producing 25,000 units, McElroy's has not exceeded its relevant range. Standard cost Flexible budget actual Favorable or Static budget (10,000 units) 360,000 Spending Variance amount Unfavorable? Revenue 36 (1?) (62) (10?) (13?) Variable Costs 21 210,000 (27) (22) (72) (112) No answer needed 15 150,000 (32) (14?) Contribution Margin Fixed costs 120,000 No answers needed 30,000 (52) No answers Needed Net Operating Income before taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts