Question: (7 points) Your company uses Black's model with caplets' forward volatilities to price caps and is interested in offering more general options. You have chosen

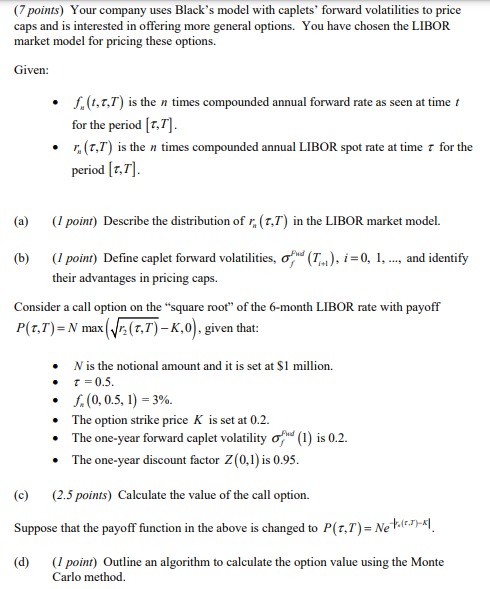

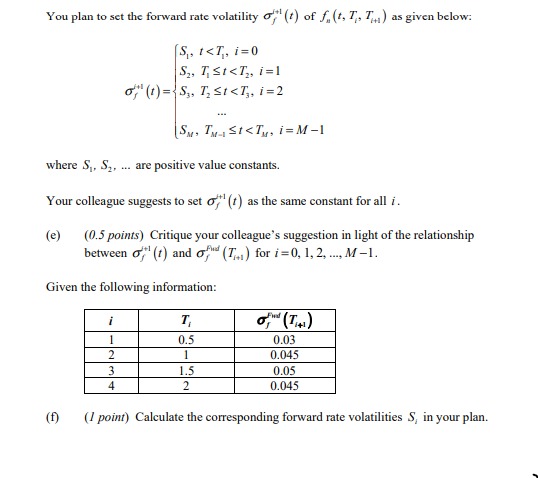

(7 points) Your company uses Black's model with caplets' forward volatilities to price caps and is interested in offering more general options. You have chosen the LIBOR market model for pricing these options. Given: . f. (t, 7,I) is the n times compounded annual forward rate as seen at time for the period [ z, 7] . r. (7,T) is the n times compounded annual LIBOR spot rate at time ? for the period [t, 7]. (a) (1 point) Describe the distribution of r (r,7) in the LIBOR market model. (b) (1 point) Define caplet forward volatilities, o (7,,, ), 1=0, 1, ..., and identify their advantages in pricing caps. Consider a call option on the "square root" of the 6-month LIBOR rate with payoff P( r,T) = N max (vn (r, T) - K, 0) , given that: N is the notional amount and it is set at $1 million. 1 = 0.5. . f. (0, 0.5, 1) = 3%. The option strike price K is set at 0.2. The one-year forward caplet volatility of"(1) is 0.2. . The one-year discount factor Z (0,1) is 0.95. (c) (2.5 points) Calculate the value of the call option. Suppose that the payoff function in the above is changed to P(r,T) = Ne (()-]. (d) (/ point) Outline an algorithm to calculate the option value using the Monte Carlo method.You plan to set the forward rate volatility of" (?) of f (t, I, 7,, ) as given below. S, 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts