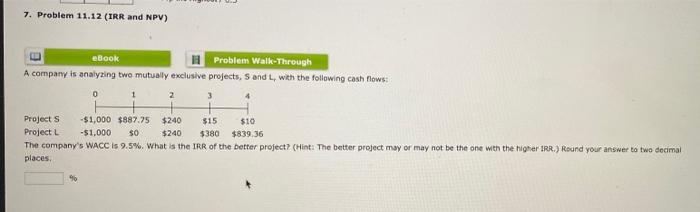

Question: 7. Problem 11.12 (IRR and NPV) eBook Problem Walk-Through A company is analyzing two mutually exclusive projects, S and L, with the following cash flows:

7. Problem 11.12 (IRR and NPV) eBook Problem Walk-Through A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 3 Projects -$1,000 $887.75 $240 $15 $10 Project L -$1,000 SO $240 $380 $839.36 The company's WACC is 9.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR) Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts