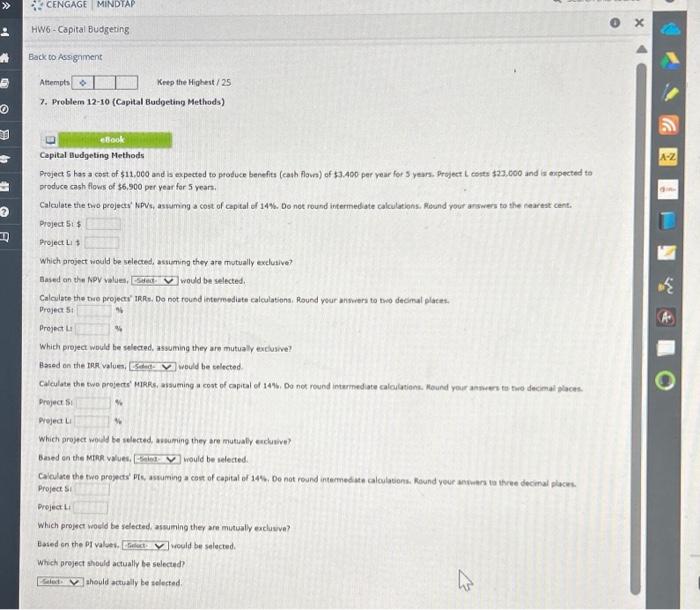

Question: 7. Problem 12-10 (Capital Eudgeting Methods) Capital Budgeting Methods Project 5 has a cost of $11,000 and is expected to peoduce benefits (cash Dawn) of

7. Problem 12-10 (Capital Eudgeting Methods) Capital Budgeting Methods Project 5 has a cost of $11,000 and is expected to peoduce benefits (cash Dawn) of $3,400 per vear for 5 years. Project L coits $23,000 and is axpected to produce cash flows of $6,900 per year for 5 yean. Preject 5: $ Project Li \$ Which project would be selected, assuming ther are mutually exclusive? Eased an the NPV velues, would be selected. Caloulate the tive project' IRRs. Do not round intermediate calculations, Round weur ansiers to thio decimal plates. Droject 5: Project Li Which project would be selected, assuming they are mutualy exclusive? Based on the ter values, weuld be exlected Project $ i Mrejecti Which preject would be selected, assuming ther are mutualy excluswe? Based en the Mtrin values. would be selected. Projects: Projecti Which project woeld be selected, assuming ther are mutualy excluwe? Eased sn the Pi values. rould be selected. Whick proyect should actually be selected? ahould actualif be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts