Question: 7. Problem 3-01 eBook Problem 3-01 You have $27,600 to invest in Sophie Shoes, a stock selling for $60 a share. The initial margin requirement

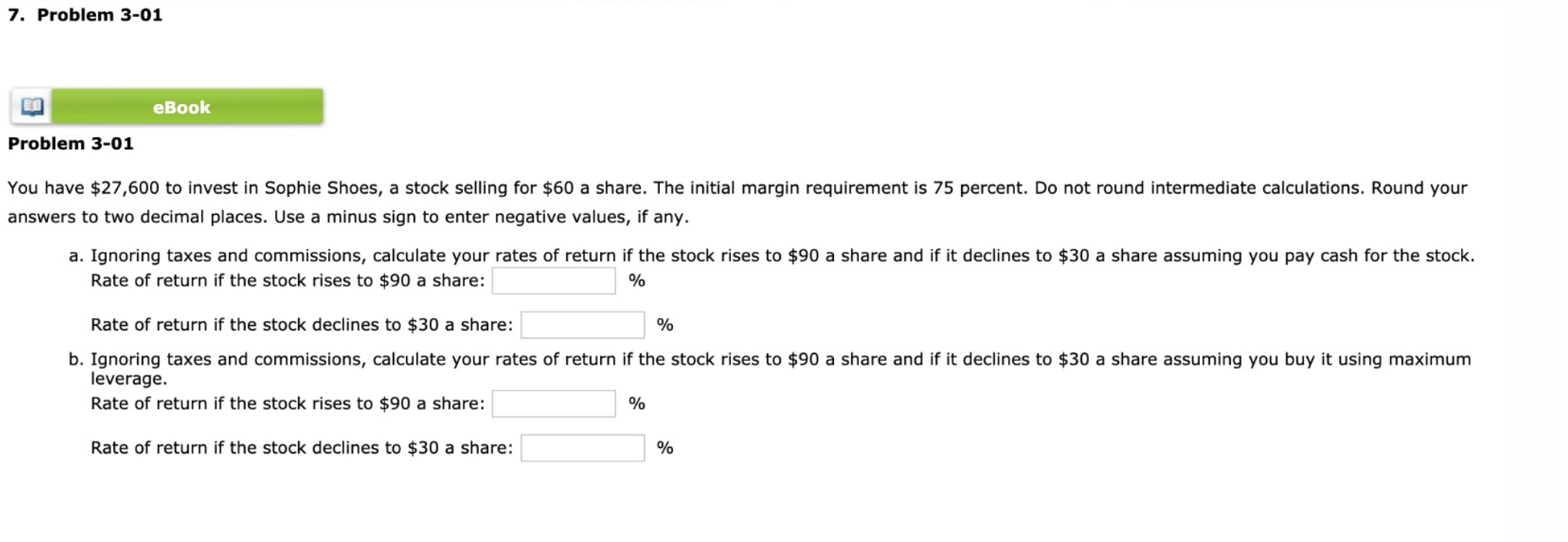

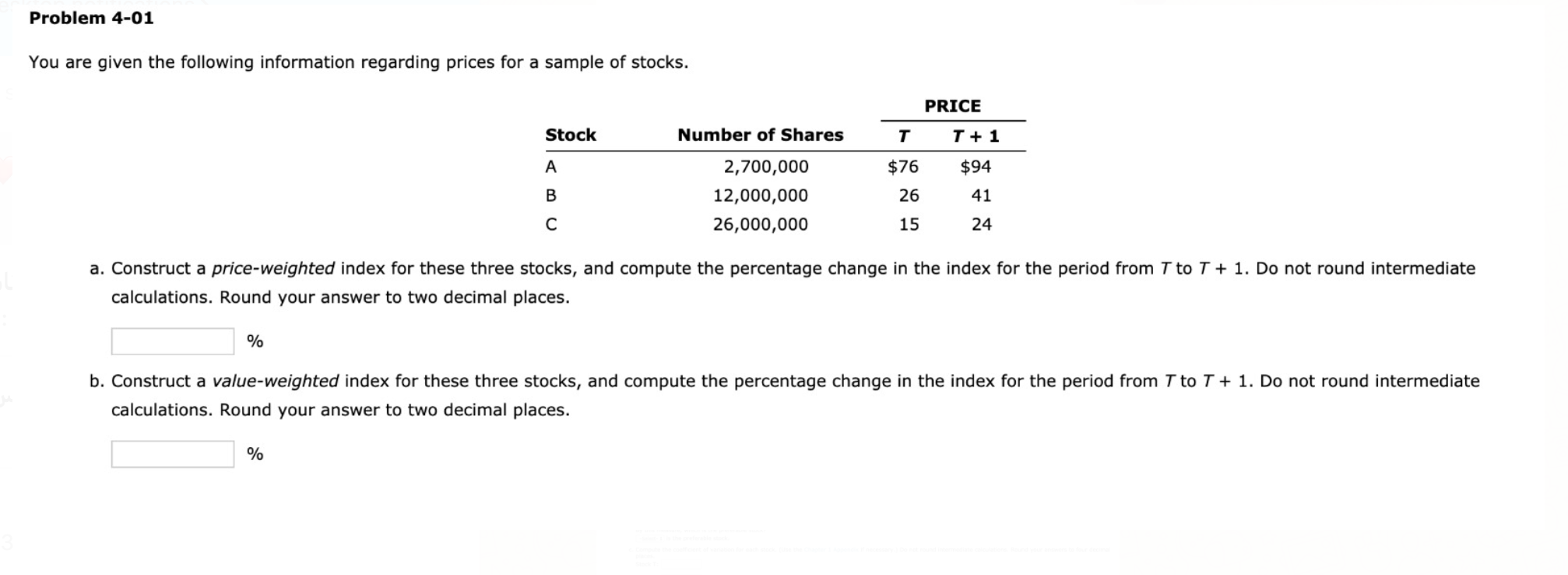

7. Problem 3-01 eBook Problem 3-01 You have $27,600 to invest in Sophie Shoes, a stock selling for $60 a share. The initial margin requirement is 75 percent. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. a. Ignoring taxes and commissions, calculate your rates of return if the stock rises to $90 a share and if it declines to $30 a share assuming you pay cash for the stock. Rate of return if the stock rises to $90 a share: % Rate of return if the stock declines to $30 a share: % b. Ignoring taxes and commissions, calculate your rates of return if the stock rises to $90 a share and if it declines to $30 a share assuming you buy it using maximum leverage. Rate of return if the stock rises to $90 a share: % Rate of return if the stock declines to $30 a share: % Problem 4-01 You are given the following information regarding prices for a sample of stocks. PRICE Stock Number of Shares T T + 1 . $76 $94 B 2,700,000 12,000,000 26,000,000 26 41 15 24 a. Construct a price-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1. Do not round intermediate calculations. Round your answer to two decimal places. % b. Construct a value-weighted index for these three stocks, and compute the percentage change in the index for the period from T to T + 1. Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts