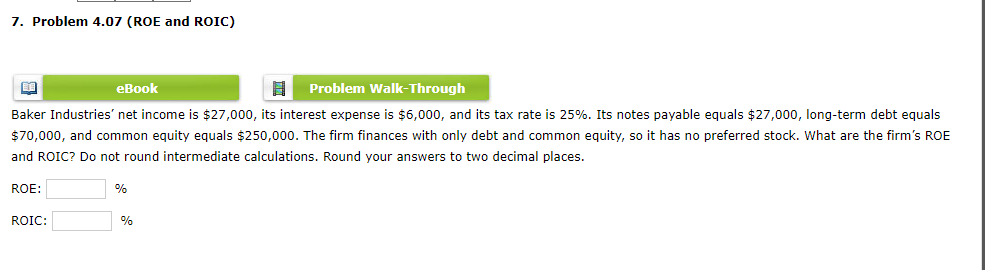

Question: 7. Problem 4.07 (ROE and ROIC) E eBook Problem Walk-Through Baker Industries' net income is $27,000, its interest expense is $6,000, and its tax rate

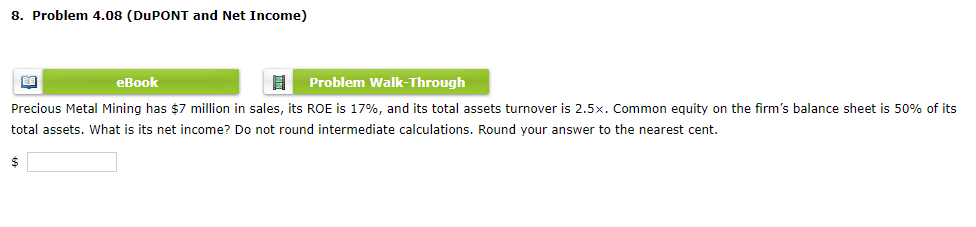

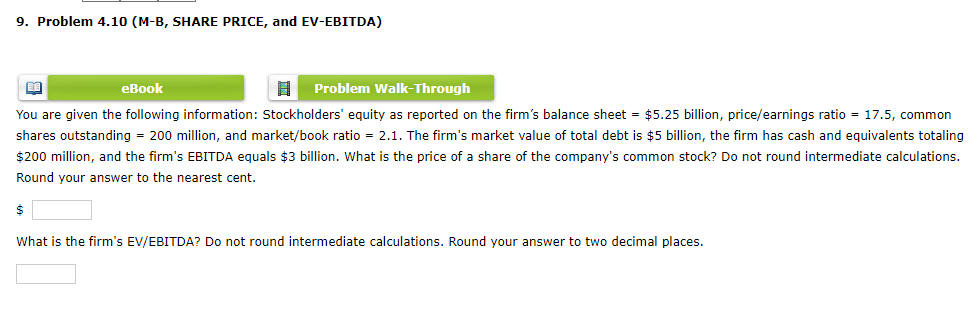

7. Problem 4.07 (ROE and ROIC) E eBook Problem Walk-Through Baker Industries' net income is $27,000, its interest expense is $6,000, and its tax rate is 25%. Its notes payable equals $27,000, long-term debt equals $70,000, and common equity equals $250,000. The firm finances with only debt and common equity, so it has no preferred stock. What are the firm's ROE and ROIC? Do not round intermediate calculations. Round your answers to two decimal places. ROE: % ROIC: % 8. Problem 4.08 (DUPONT and Net Income) EB eBook Problem Walk-Through Precious Metal Mining has $7 million in sales, its ROE is 17%, and its total assets turnover is 2.5x. Common equity on the firm's balance sheet is 50% of its total assets. What is its net income? Do not round intermediate calculations. Round your answer to the nearest cent. $ 9. Problem 4.10 (M-B, SHARE PRICE, and EV-EBITDA) ER eBook Problem Walk-Through You are given the following information: Stockholders' equity as reported on the firm's balance sheet = $5.25 billion, price/earnings ratio = 17.5, common shares outstanding = 200 million, and market/book ratio = 2.1. The firm's market value of total debt is $5 billion, the firm has cash and equivalents totaling $200 million, and the firm's EBITDA equals $3 billion. What is the price of a share of the company's common stock? Do not round intermediate calculations. Round your answer to the nearest cent. $ What is the firm's EV/EBITDA? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts