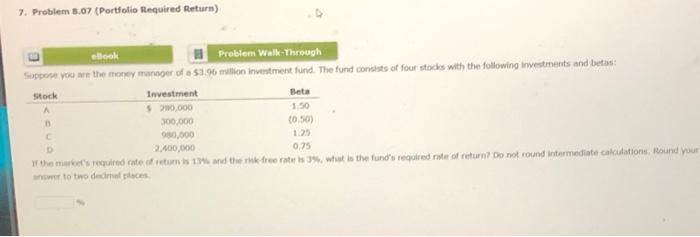

Question: 7. Problem 5.07 (Portfolio Required Return) A etlook Problem Walk-Through Support you are the money manager of a $3.9 million investment fund. The fund consists

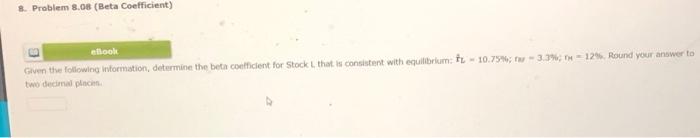

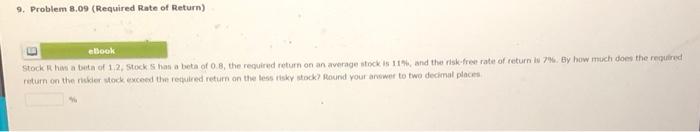

7. Problem 5.07 (Portfolio Required Return) A etlook Problem Walk-Through Support you are the money manager of a $3.9 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta $70,000 1.50 300,000 (050) 90,000 200.000 0.25 of the muretsered cate o retomis 1 and the rike free rate is what is the fund's required rate of return? Do not found intermediate calculations, Round your wower to two decacies 125 D 8. Problem 8.08 (Beta Coefficient) etlook Given the following information, determine the beta coeficient for Stock Lthat is consistent with equilibrium: -10.75 -3.3%, 12. Round your answer to two decimal plic 9. Problem 8.09 (Required Rate of Return) ebook Stock this bea of 12, Stockho a bea of 0.8, the required return on an average stocks 11 and the risk-free rate of return v 7. By how much does the required return on the riskler stock exceed the retired return on the sky stock Round your avower to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts