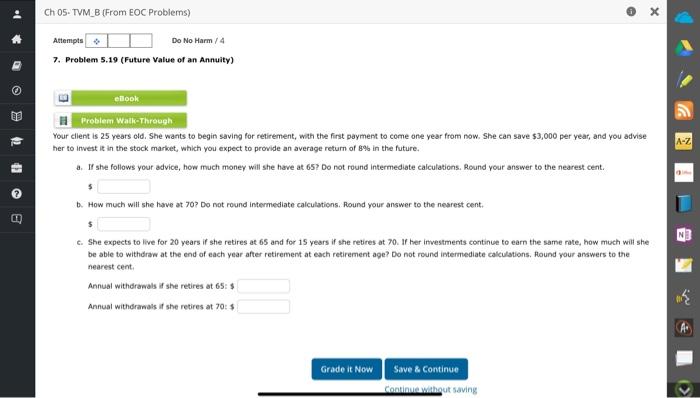

Question: 7. Problem 5.19 (Future Value of an Annuity) Your client is 25 years old. she wants to begin saving for retirement, with the first payment

7. Problem 5.19 (Future Value of an Annuity) Your client is 25 years old. she wants to begin saving for retirement, with the first payment to come one year from now. she can save $3, 000 per yeat, and you advise her to invest it in the stock market, which you expect to provide an average return of go in the future. a. If she follows your advice, how much money will she have at 65 ? Do not round intermediate calculations. Round your answer to the nearest cent. 5 b. How moch will she have at 70 ? Do not round intermediate calculations. Found your answer to the nearest cent. 5 c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70. If her imvestments continue to earn the same rate, how much wili she be able to withdraw at the end of each year after retirement at each retirement age? Do not round intermediate calculations. Alound your answers to the nearest cent. Annual withdrawals if she retires at 65 : $ Annual withdrawals if she retires at 70: 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts