Question: 7 Question 7 (submit code This question will carry more weight than the others, maybe double weight. . A convertible bond is an equity derivative

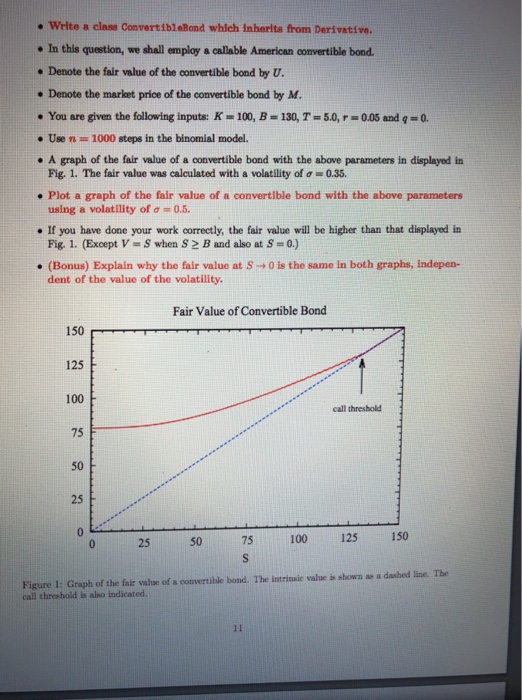

7 Question 7 (submit code This question will carry more weight than the others, maybe double weight. . A convertible bond is an equity derivative with the following characteristics 1. It has a strike K and expiration T and can be American or European. 2. The terminal payof is terminal payoff max(Sr, K) 3. This is similar to the payoff in Midterm 2 Question 6(a). 4. What this means is that if Sr 2 K at expiration, the holder receives one share of stodk and if St B at any time, the convertible bond terminates. The value of the convertible bond if called in this way is v # s. 9. Hence in addition to early exercise, we add one more feature to the valuation tests, which In more detail, a convertible bond is intermediate between a bond and an option. 1. A convertible bond also pays coupons. 2. We shall ignore coupons and consider only a zero coupon convertible bond. 3. Zero coupon convertible bonds do exist. . Prove that V 2 PV(K) for a zero coupon convertible bond. Convertible bonds are issued by companies, and when an investor exercises a convertible bond, the company prints new shares of stock and delivers them to the investor. . In that sense, convertible bonds are diferent from exchange listed options and are more similar to warrants. Convertible bonds usually have much longer expiration times than exchange listed options, extending many years (30 years is not uncommon). a longer time horizon than is possible with exchange listed options. Sce next page. . One reason investors buy convertible bonds is because they can perform gamma trading with . In this question, we shall perform gamma trading with a convertible bond. 10 7 Question 7 (submit code This question will carry more weight than the others, maybe double weight. . A convertible bond is an equity derivative with the following characteristics 1. It has a strike K and expiration T and can be American or European. 2. The terminal payof is terminal payoff max(Sr, K) 3. This is similar to the payoff in Midterm 2 Question 6(a). 4. What this means is that if Sr 2 K at expiration, the holder receives one share of stodk and if St B at any time, the convertible bond terminates. The value of the convertible bond if called in this way is v # s. 9. Hence in addition to early exercise, we add one more feature to the valuation tests, which In more detail, a convertible bond is intermediate between a bond and an option. 1. A convertible bond also pays coupons. 2. We shall ignore coupons and consider only a zero coupon convertible bond. 3. Zero coupon convertible bonds do exist. . Prove that V 2 PV(K) for a zero coupon convertible bond. Convertible bonds are issued by companies, and when an investor exercises a convertible bond, the company prints new shares of stock and delivers them to the investor. . In that sense, convertible bonds are diferent from exchange listed options and are more similar to warrants. Convertible bonds usually have much longer expiration times than exchange listed options, extending many years (30 years is not uncommon). a longer time horizon than is possible with exchange listed options. Sce next page. . One reason investors buy convertible bonds is because they can perform gamma trading with . In this question, we shall perform gamma trading with a convertible bond. 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts