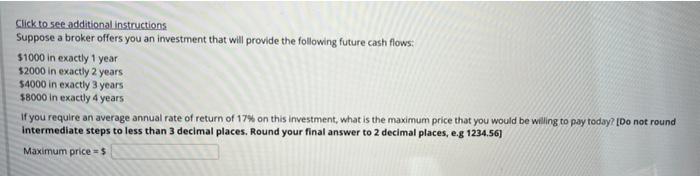

Question: 7 see additional instructions here Click to see additional instructions Suppose a broker offers you an investment that will provide the following future cash flows:

Click to see additional instructions Suppose a broker offers you an investment that will provide the following future cash flows: $1000 in exactly 1 year 52000 in exactly 2 years $4000 in exactly 3 years 58000 in exactly 4 years If you require an average annual rate of return of 17% on this investment, what is the maximum price that you would be willing to pay today? [Do not round intermediate steps to less than 3 decimal places, Round your final answer to 2 decimal places, e.g 1234.56) Maximum prices as Accepted characters: numbers, decimal point markers, sign indicators (-), spaces (eg., as thousands separator, 5 000). "E" or "e" (used in scientific notation). NOTE: For scientific notation, a period MUST be used as the decimal point marker. Complex numbers should be in the form (a + bi) where "a" and "b" need to have explicitly stated values. For example: (1+11) is valid whereas (1+1) is not. (0+9i) is valid whereas (91) is not. I rate of return of 17% on this investment, what is the maximum price that you would be willing to pay today? [Do not round an 3 decimal places. Round your final answer to 2 decimal places, e.g 1234.56]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts