Question: 7 Single Sheet is preparing its payroll for week #1 in November. Year-to-date through October (YTD) information follows for its 4 employees. State income tax

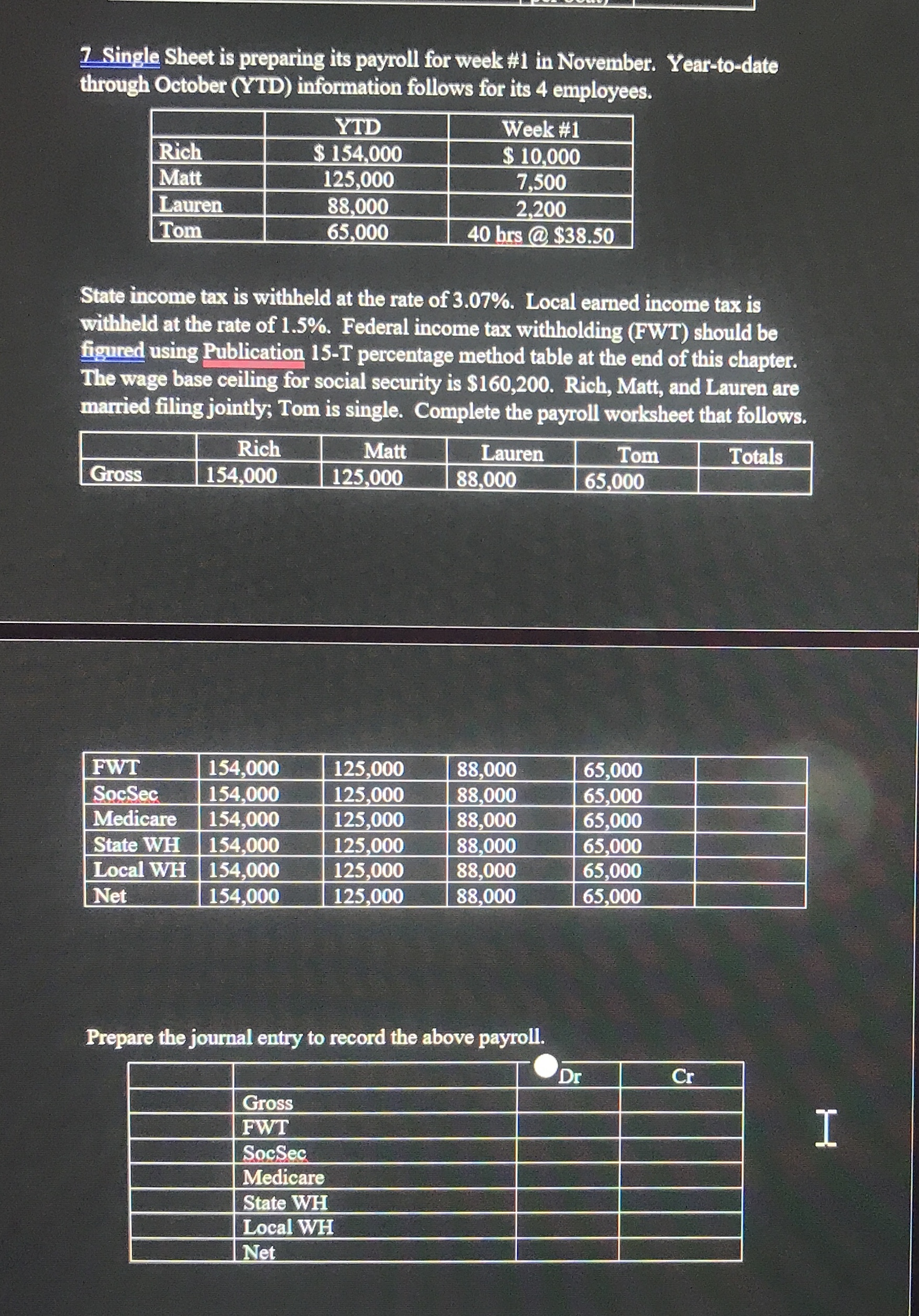

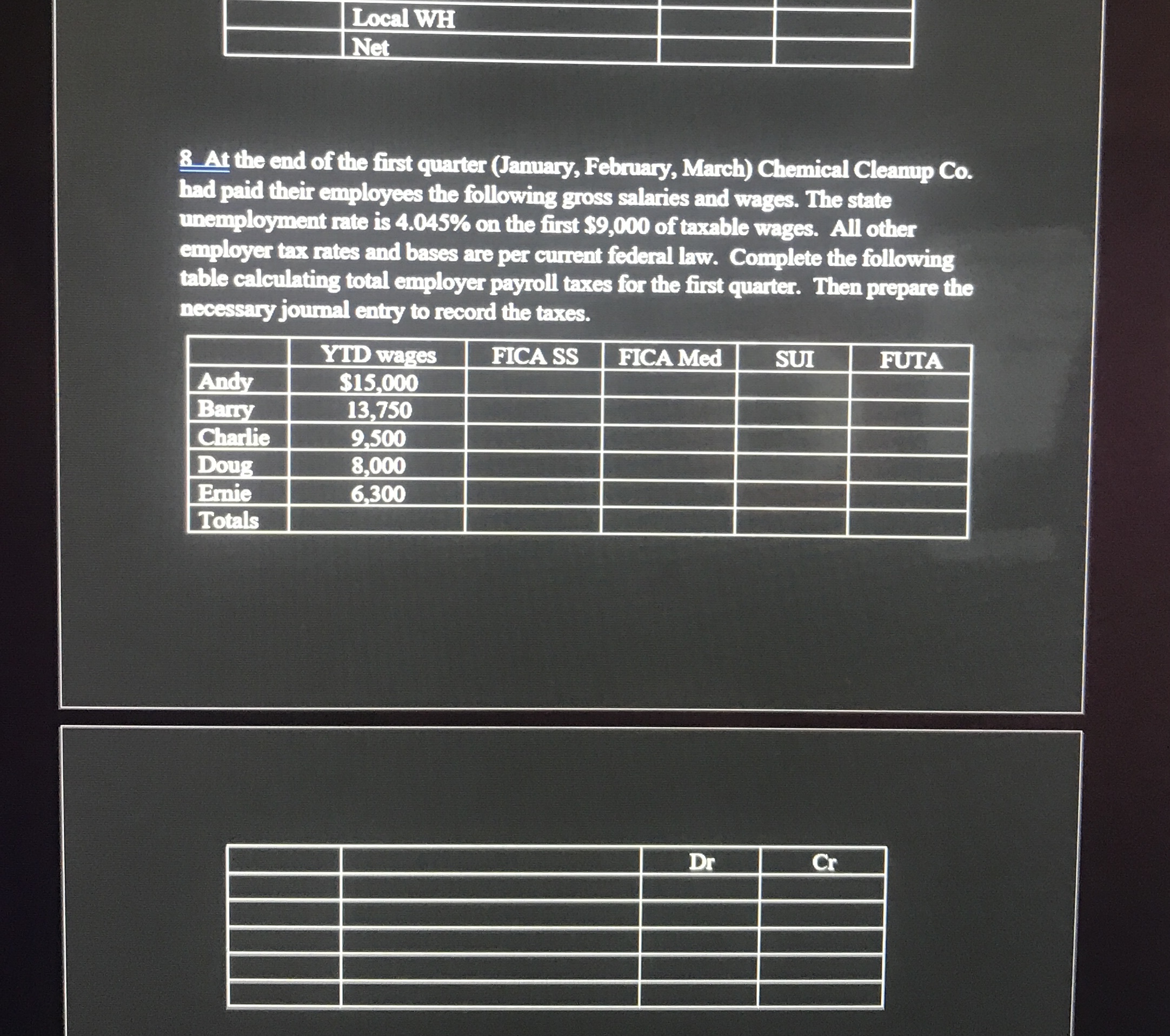

7 Single Sheet is preparing its payroll for week #1 in November. Year-to-date through October (YTD) information follows for its 4 employees. State income tax is withheld at the rate of 3.07%. Local earned income tax is withheld at the rate of 1.5%. Federal income tax withholding (FWT) should be figured using Publication 15-T percentage method table at the end of this chapter. The wage base ceiling for social security is $160,200. Rich, Matt, and Lauren are married filing jointly; Tom is single. Complete the payroll worksheet that follows. Prepare the journal entry to record the above payroll. 8 At the end of the first quarter (January, February, March) Chemical Cleanup Co. had paid their employees the following gross salaries and wages. The state unemployment rate is 4.045% on the first $9,000 of taxable wages. All other employer tax rates and bases are per current federal law. Complete the following table calculating total employer payzoll taxes for the first quarter. Then prepare the necessary joumal entry to record the taxes. 7 Single Sheet is preparing its payroll for week #1 in November. Year-to-date through October (YTD) information follows for its 4 employees. State income tax is withheld at the rate of 3.07%. Local earned income tax is withheld at the rate of 1.5%. Federal income tax withholding (FWT) should be figured using Publication 15-T percentage method table at the end of this chapter. The wage base ceiling for social security is $160,200. Rich, Matt, and Lauren are married filing jointly; Tom is single. Complete the payroll worksheet that follows. Prepare the journal entry to record the above payroll. 8 At the end of the first quarter (January, February, March) Chemical Cleanup Co. had paid their employees the following gross salaries and wages. The state unemployment rate is 4.045% on the first $9,000 of taxable wages. All other employer tax rates and bases are per current federal law. Complete the following table calculating total employer payzoll taxes for the first quarter. Then prepare the necessary joumal entry to record the taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts