Question: 7. South Bend Building Services needs to replace a worn-out floor-stripping machine. A machine similar to the one being replaced costs $3,000. A new type

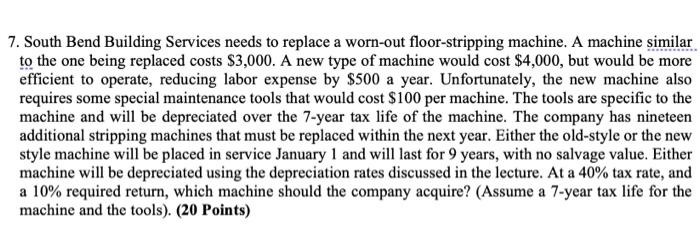

7. South Bend Building Services needs to replace a worn-out floor-stripping machine. A machine similar to the one being replaced costs $3,000. A new type of machine would cost $4,000, but would be more efficient to operate, reducing labor expense by $500 a year. Unfortunately, the new machine also requires some special maintenance tools that would cost $100 per machine. The tools are specific to the machine and will be depreciated over the 7-year tax life of the machine. The company has nineteen additional stripping machines that must be replaced within the next year. Either the old-style or the new style machine will be placed in service January 1 and will last for 9 years, with no salvage value. Either machine will be depreciated using the depreciation rates discussed in the lecture. At a 40% tax rate, and a 10% required return, which machine should the company acquire? (Assume a 7-year tax life for the machine and the tools) (20 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts