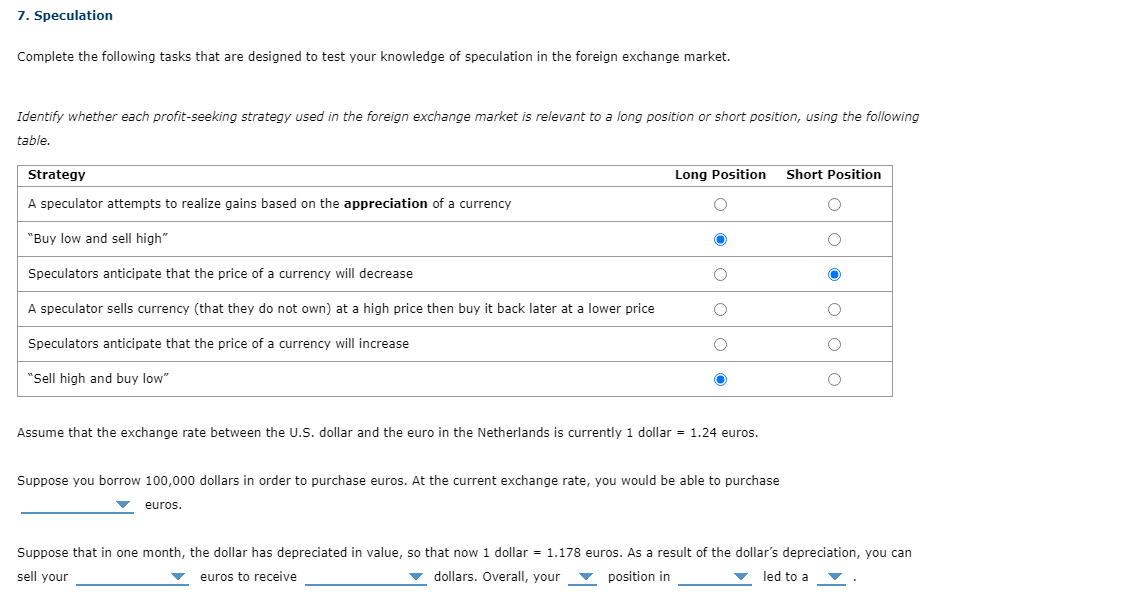

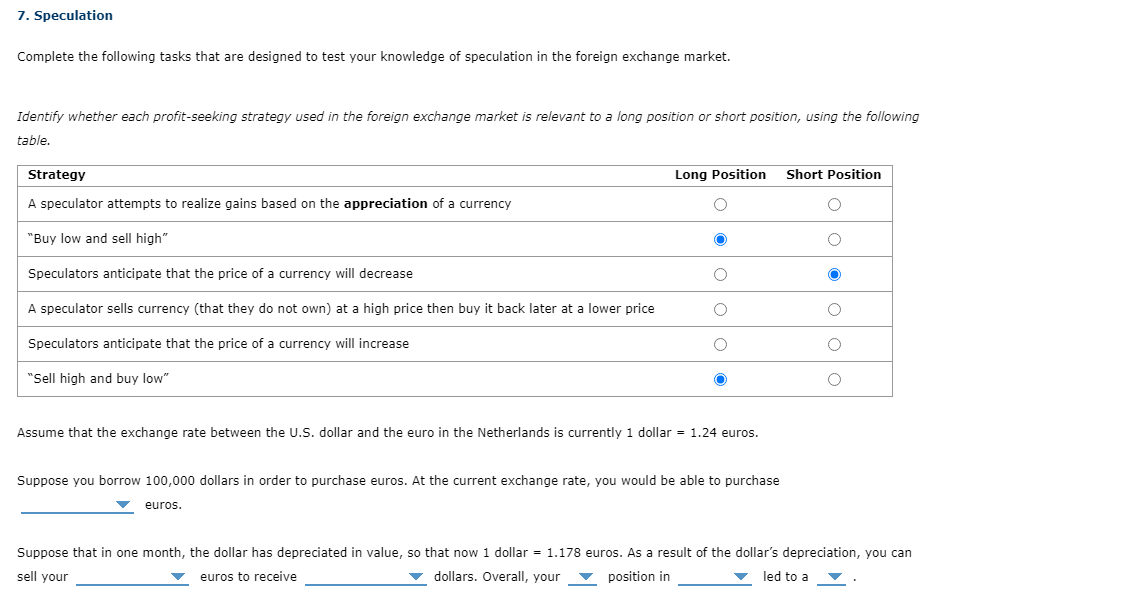

Question: 7. Speculation Complete the following tasks that are designed to test your knowledge of speculation in the foreign exchange market. Identify whether each profitseeking strategy

7. Speculation Complete the following tasks that are designed to test your knowledge of speculation in the foreign exchange market. Identify whether each profitseeking strategy used in the foreign exchange market is relevant to a long position or short position, using the following tabie. Strategy Long Position Short Position A speculator attempts to realize gains based on the appreciation of a currency 0 O \"Buy low and sell high\" Speculators anticipate that the price of a currency will decrease A speculator sells currency (that they do not own] at a high price then buy it back later at a lower price Speculators anticipate that the price of a currency will increase OOO OOOO \"Sell high and buy low\" Assume that the exchange rate between the U.S. dollar and the euro in the Netherlands is currently 1 dollar = 1.24 euros. Suppose you borrowI 100,000 dollars in order to purchase euros. At the current exchange rate, you I.yould be able to purchase v EUFDS. Suppose that in one month, the dollar has depreciated in value, so that now 1 dollar = 1.13% euros. As a result of the dollar's depreciation, you can sell your v euros to receive v dollars. Overall, your v position in v led to a v

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts