Question: 7. Suppose you are evaluating two mutually exclusive projects, Thing 3 and Thing 4, with the following cash flows: End-of-year cash flows Year Thing 3

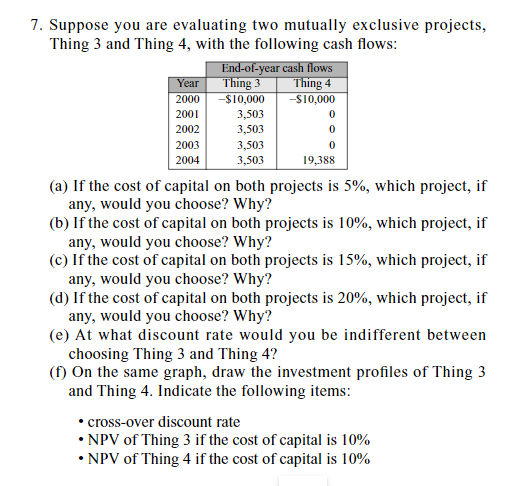

7. Suppose you are evaluating two mutually exclusive projects, Thing 3 and Thing 4, with the following cash flows: End-of-year cash flows Year Thing 3 Thing 4 2000 -$10,000 -$10,000 2001 3,503 3,503 3,503 3,503 19,388 2002 2003 0 2004 (a) If the cost of capital on both projects is 5%, which project, if any, would you choose? Why? (b) If the cost of capital on both projects is 10%, which project, if any, would you choose? Why? (c) If the cost of capital on both projects is 15%, which project, if any, would you choose? Why? (d) If the cost of capital on both projects is 20%, which project, if any, would you choose? Why? (e) At what discount rate would you be indifferent between choosing Thing 3 and Thing 4? (f) On the same graph, draw the investment profiles of Thing 3 and Thing 4. Indicate the following items: cross-over discount rate NPV of Thing 3 if the cost of capital is 10% NPV of Thing 4 if the cost of capital is 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts