Question: 7. Suppose you buy shares of a stock worth OMR10000 and the initial margin is 50% and the maintenance margin is 30%. A. How much

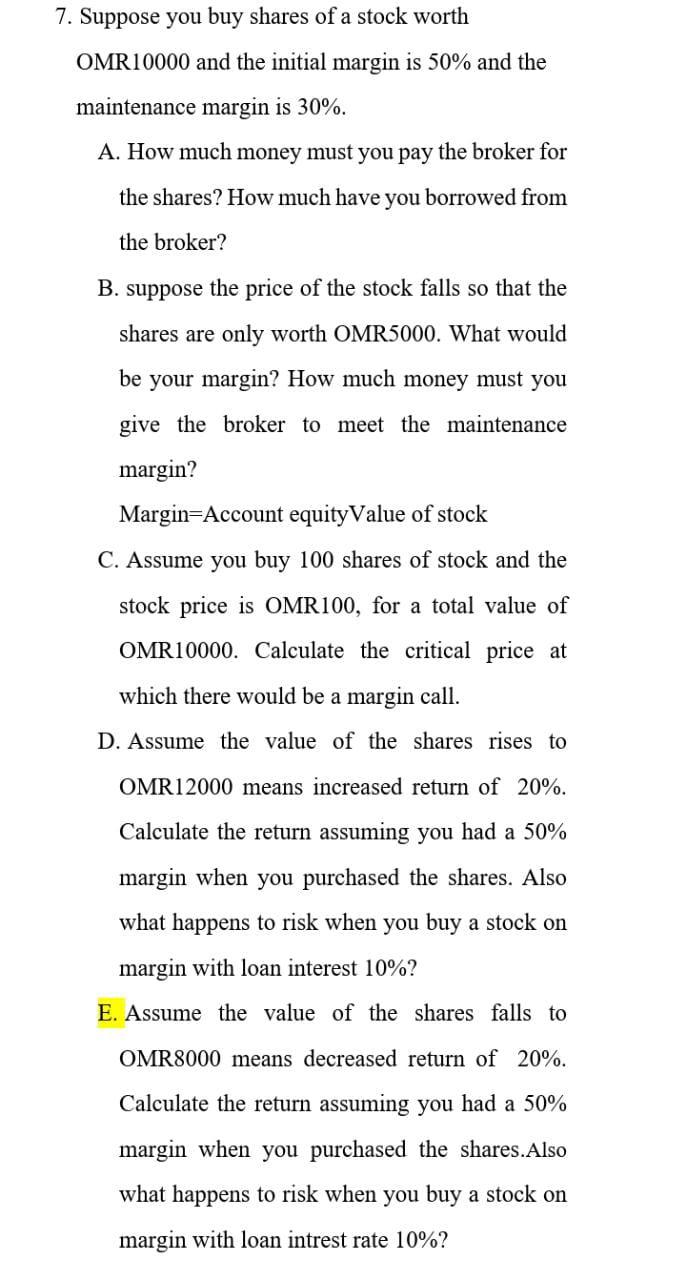

7. Suppose you buy shares of a stock worth OMR10000 and the initial margin is 50% and the maintenance margin is 30%. A. How much money must you pay the broker for the shares? How much have you borrowed from the broker? B. suppose the price of the stock falls so that the shares are only worth OMR5000. What would be your margin? How much money must you give the broker to meet the maintenance margin? Margin=Account equityValue of stock C. Assume you buy 100 shares of stock and the stock price is OMR 100, for a total value of OMR10000. Calculate the critical price at which there would be a margin call. D. Assume the value of the shares rises to OMR12000 means increased return of 20%. Calculate the return assuming you had a 50% margin when you purchased the shares. Also what happens to risk when you buy a stock on margin with loan interest 10%? E. Assume the value of the shares falls to OMR8000 means decreased return of 20%. Calculate the return assuming you had a 50% margin when you purchased the shares.Also what happens to risk when you buy a stock on margin with loan intrest rate 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts