Question: 7. The analyst expects that Wolf Solutions Inc. (WSI) will have earnings per share of $2 for the coming year. WSI plans to retain all

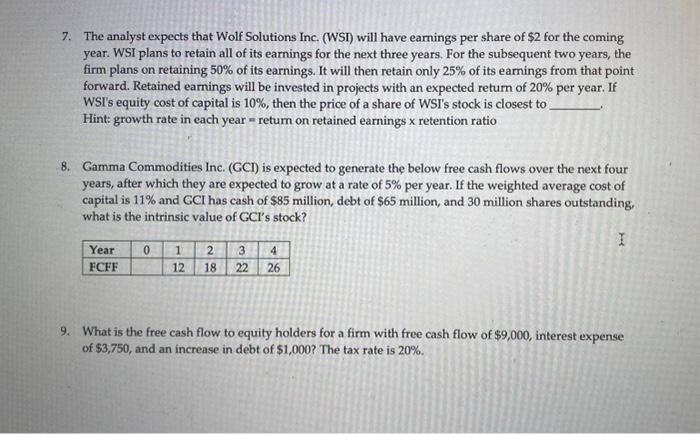

7. The analyst expects that Wolf Solutions Inc. (WSI) will have earnings per share of $2 for the coming year. WSI plans to retain all of its earnings for the next three years. For the subsequent two years, the firm plans on retaining 50% of its earnings. It will then retain only 25% of its earnings from that point forward. Retained earnings will be invested in projects with an expected return of 20% per year. If WSI's equity cost of capital is 10%, then the price of a share of WSI's stock is closest to Hint: growth rate in each year = return on retained earnings x retention ratio 8. Gamma Commodities Inc. (GCI) is expected to generate the below free cash flows over the next four years, after which they are expected to grow at a rate of 5% per year. If the weighted average cost of capital is 11% and GCI has cash of $85 million, debt of $65 million, and 30 million shares outstanding, what is the intrinsic value of GCI's stock? 9. What is the free cash flow to equity holders for a firm with free cash flow of $9,000, interest expense of $3,750, and an increase in debt of $1,000 ? The tax rate is 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts