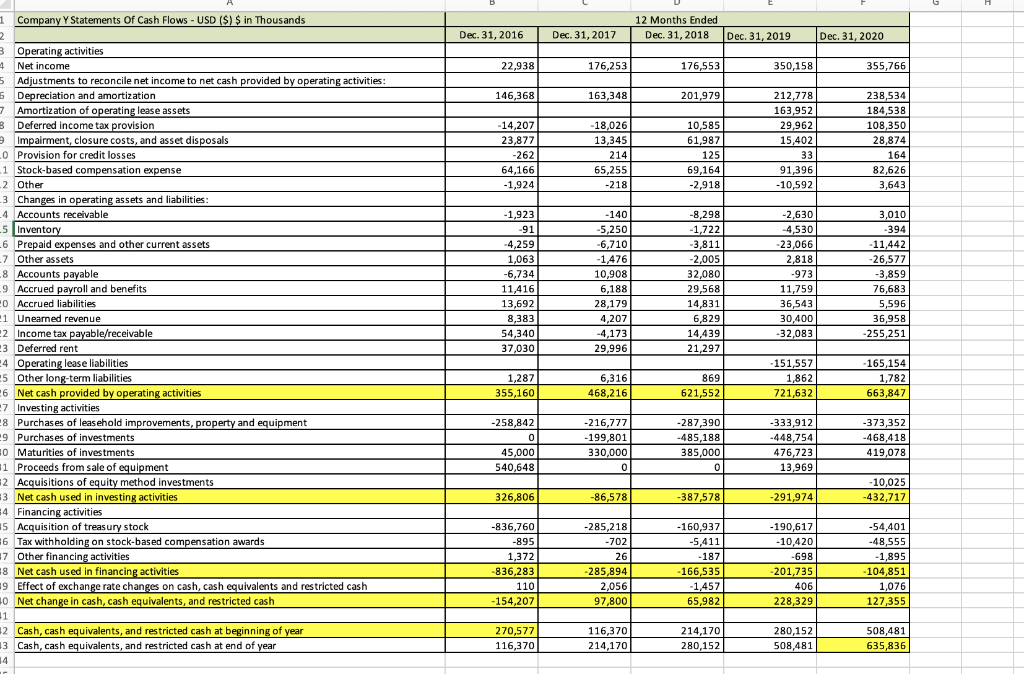

Question: 7. The Cash Flows from Operating Activities are highlighted in this cash flow statement. What does the trend in these cash flows tell you about

7. The Cash Flows from Operating Activities are highlighted in this cash flow statement. What does the trend in these cash flows tell you about this firm?

8. Look at the Cash Flows from Financing Activities for this firm. What does the trend in these cash flows tell you about this firm? Does this trend look healthy? Explain.

9. Does it look like this firm acquired another company during this time, and if so, what years?

10. Add the Cash Flow from Operating activities to the Cash flow from Investing Activities. The Cash Flow from Investing Activities is typically a negative, so when it is, you will be subtracting it from Operating cash flows. If the results is positive, they brought in more from operations than they spent on new investments. If it is negative, they spent more on investments than they brought in from operations. This number is called "Free Cash Flow" . Record the Free Cash Flow for each year and then comment on whether the trend in that looks good or bad.

11. Look at the financing cash flow for 2020. Most restaurants had negative free cash flow for 2020 because of the pandemic. Look at the financing cash flows. What did this company do with their extra free cash flow in 2020?

12. What happened to their cash balance over time? Does this look good or bad?

12 Months Ended Dec. 31, 2018 Dec 31, 2016 Dec. 31, 2017 Dec 31, 2019 Dec. 31, 2020 22,938 176,253 176,553 350,158 355,766 146,368 163,348 201.979 -14,207 23,877 -262 64,166 -1,924 -18,026 13,345 214 65,255 -218 10,585 61,987 125 69,164 -2,918 212,778 163,952 29,962 15,402 33 91,396 -10,592 238,534 184,538 108,350 28,874 164 82,626 3,643 1 Company Y Statements of Cash Flows - USD ($) $ in Thousands 2 3 Operating activities 4 Net income Adjustments to reconcile net income to net cash provided by operating activities 5 Depreciation and amortization 7 Amortization of operating lease assets B Deferred income tax provision Impairment, closure costs, and asset disposals 0 Provision for credit losses 1 Stock-based compensation expense 2 Other 3 Changes in operating assets and liabilities 4 Accounts receivable -5 Inventory 6 Prepaid expenses and other current assets -7 Other assets 8 Accounts payable 9 Accrued payroll and benefits 20 Accrued liabilities -1 Unearned revenue 2 Income tax payable/receivable 23 Deferred rent -4 Operating lease liabilities 5 5 Other long-term liabilities 26 Net cash provided by operating activities 7 Investing activities 8 Purchases of leasehold improvements, property and equipment 9 Purchases of investments 10 Maturities of investments 1 Proceeds from sale of equipment 2 Acquisitions of equity method investments +3 Net cash used in investing activities 4 Financing activities 5 Acquisition of treasury stock 6 Tax with holding on stock-based compensation awards 17 Other financing activities 18 Net cash used in financing activities 9 Effect of exchange rate changes on cash, cash equivalents and restricted cash 0 Net change in cash, cash equivalents, and restricted cash 11 2 Cash, cash equivalents, and restricted cash at beginning of year 3 Cash, cash equivalents, and restricted cash at end of year 14 -1,923 -91 -4,259 1,063 -6,734 11,416 13,692 8,383 54,340 37,030 -140 -5,250 -6,710 -1,476 10.908 6,188 28,179 4,207 -4,173 29,996 -8.298 -1,722 -3,811 -2,005 32,080 29,568 14,831 6,829 14,439 21,297 -2,630 -4,530 -23,066 2,818 -973 11,759 36,543 30,400 -32,083 3,010 -394 -11,442 -26,577 -3,859 76,683 5,596 36,958 -255,251 1,287 355,160 6,316 468,216 869 621,552 -151,557 1,862 721,632 -165,154 1,782 663,847 -258,842 0 45,000 540,648 -216,777 -199,801 330,000 0 -287,390 -485,188 385,000 0 -333,912 -448,754 476,723 13,969 -373,352 -468,418 419,078 - 10,025 -432,717 326,806 -86,578 -387,578 -291,974 -836,760 -895 1.372 836,283 110 -154,207 -285,218 -702 26 -285,894 2,056 97,800 -160,937 -5,411 -187 -166,535 -1,457 65,982 - 190,617 -10,420 -698 -201,735 406 228,329 -54,401 -48,555 -1,895 -104,851 1,076 127,355 270,577 116,370 116,370 214,170 214,170 280,152 280,152 508,481 508,481 635,836

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts