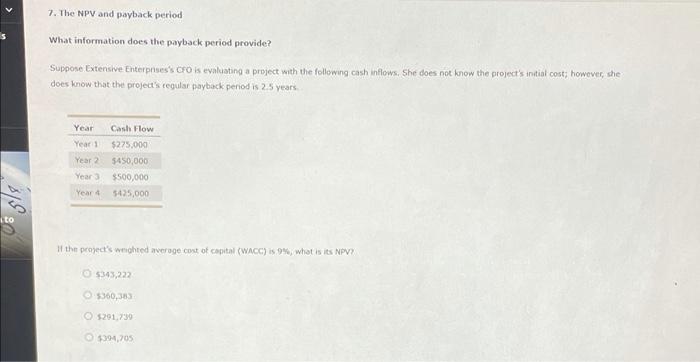

Question: 7. The NPV and payback period What information does the payback period provide? Suppose Extensive Enterprises CFO is evaluating a project with the following cash

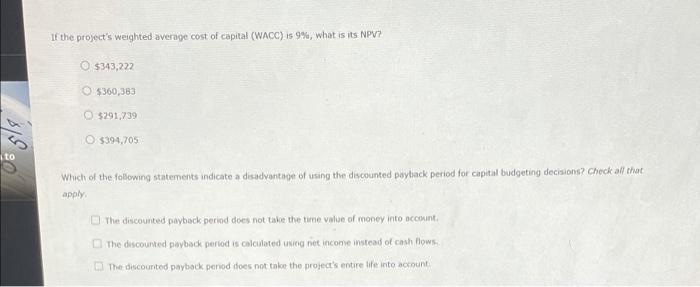

7. The NPV and payback period What information does the payback period provide? Suppose Extensive Enterprises CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years Year Year 1 Year Cash Flow $275,000 5450,000 $500,000 5425,000 Year Year 4 012 If the project's weighted average cost of capital (WACC) is 9%, what is its NPV 5343,222 $360,38 5291,739 $394,705 If the project's weighted average cost of capital (WACC) is 9%, what is its NPV? $343,222 $360,383 5291,739 $394,705 Which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply The discounted payback period does not take the time value of money into account The discounted payback period is calculated using net income instead of cash flows 01 The discounted payback period does not take the project's entire life into account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts