Question: 7. The Step-it-Up company will issue zero coupon bonds this coming month. The projected Yield for the bond is 7%, the par value of each

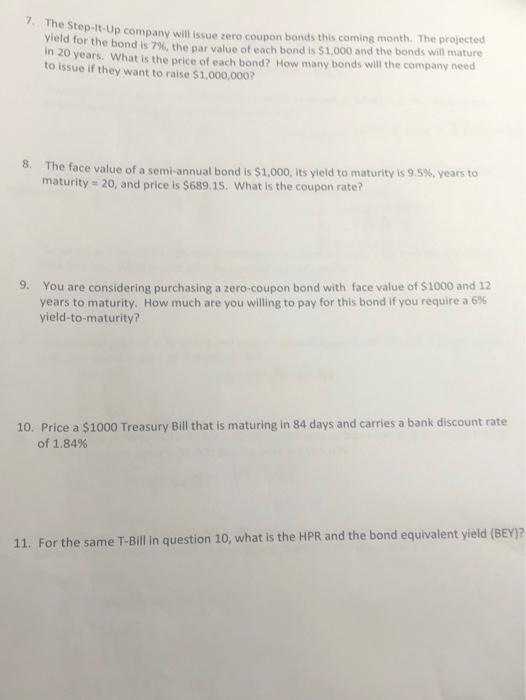

7. The Step-it-Up company will issue zero coupon bonds this coming month. The projected Yield for the bond is 7%, the par value of each bond is $1,000 and the bonds will mature in 20 years. What is the price of each bond? How many bonds will the company need to issue if they want to raise $1,000,000? 8 The face value of a semi-annual bond is $1,000, its yield to maturity is 9.5% years to maturity = 20, and price is $689.15. What is the coupon rate? 9. You are considering purchasing a zero-coupon bond with face value of $1000 and 12 years to maturity. How much are you willing to pay for this bond if you require a 6% yield-to-maturity? 10. Price a $1000 Treasury Bill that is maturing in 84 days and carries a bank discount rate of 1.84% 11. For the same T-Bill in question 10, what is the HPR and the bond equivalent yield (BEY)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts