Question: (7) This problem asks you to value some path-dependent options using one of the meth ods discussed in the Section 7 notes. Use the 3-period

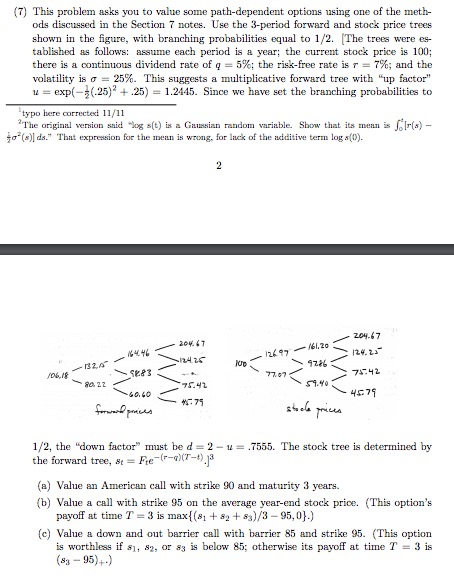

(7) This problem asks you to value some path-dependent options using one of the meth ods discussed in the Section 7 notes. Use the 3-period forward and stock price trees shown in the figure, with branching probabilities equal to 1/2. [The trees were es- tablished as follows: assume each period is a year; the current stock price is 100; there is a continuous dividend rate of q-5%; the risk-free rate is r = 7%; and the volatility is --25%. This suggests a multiplicative forward tree with "up factor" u exp25)25) 1.2445. Since we have set the branching probabilities to typo here corrected 11/11 The original version said ()is a Gaussian random variable. Show that its mean is (s) - ds. That expression for the mean is wrong, for luck of the additive term log(0). 7707 4571 1/2, the "down factors must be d = 2-11 = .7555. The stock tree is determined by the forward tree, s-Fe-(r-q)(T-t)13 (a) Value an American call with strike 90 and maturity 3 years. (b) Value a call with strike 95 on the average year-end stock prioe. (This option's payoff at time T-3 is max(s82+s3)/3-95,0.) (c) Value a down and out barrier call with barrier 85 and strike 95. (This option is worthless if s1, 82, or s3 is below 85; otherwise its payoff at time T-3 is (83-95)+) (7) This problem asks you to value some path-dependent options using one of the meth ods discussed in the Section 7 notes. Use the 3-period forward and stock price trees shown in the figure, with branching probabilities equal to 1/2. [The trees were es- tablished as follows: assume each period is a year; the current stock price is 100; there is a continuous dividend rate of q-5%; the risk-free rate is r = 7%; and the volatility is --25%. This suggests a multiplicative forward tree with "up factor" u exp25)25) 1.2445. Since we have set the branching probabilities to typo here corrected 11/11 The original version said ()is a Gaussian random variable. Show that its mean is (s) - ds. That expression for the mean is wrong, for luck of the additive term log(0). 7707 4571 1/2, the "down factors must be d = 2-11 = .7555. The stock tree is determined by the forward tree, s-Fe-(r-q)(T-t)13 (a) Value an American call with strike 90 and maturity 3 years. (b) Value a call with strike 95 on the average year-end stock prioe. (This option's payoff at time T-3 is max(s82+s3)/3-95,0.) (c) Value a down and out barrier call with barrier 85 and strike 95. (This option is worthless if s1, 82, or s3 is below 85; otherwise its payoff at time T-3 is (83-95)+)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts