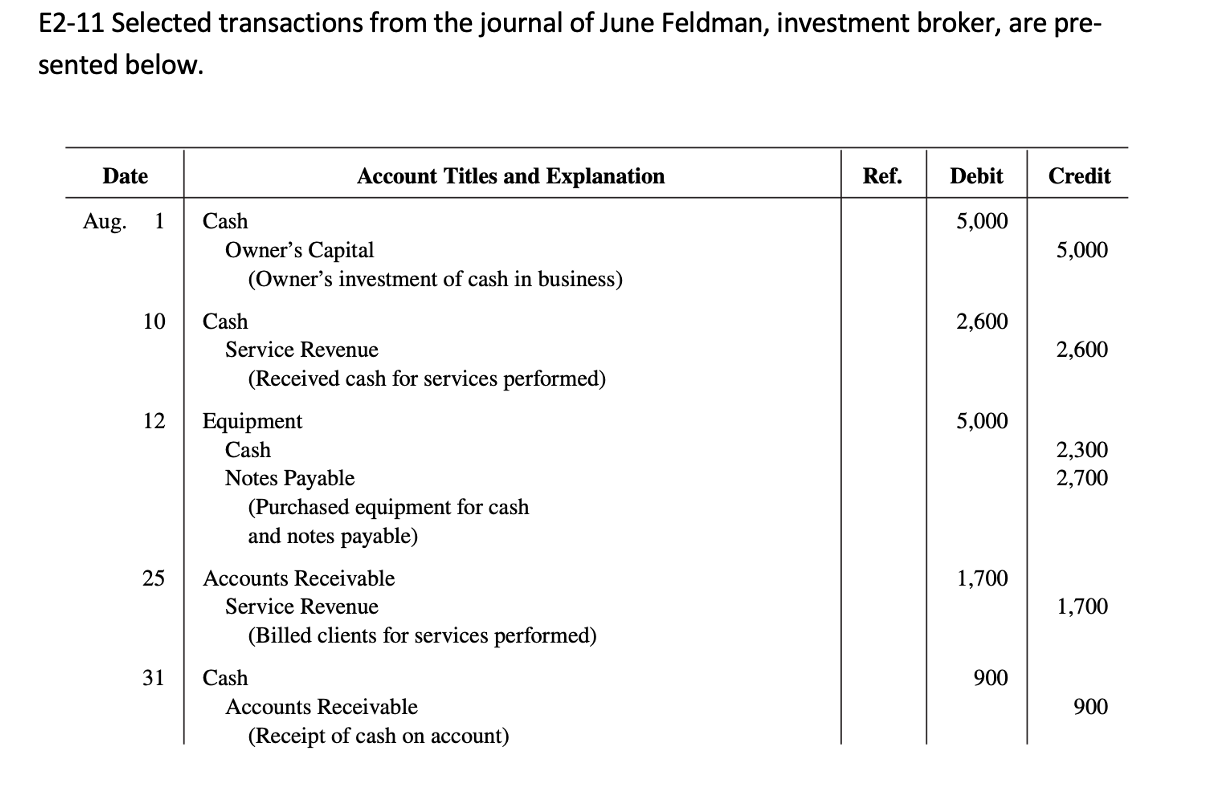

Question: 7 TO 12. PLEASE ANSWER. E2-11 Selected transactions from the journal of June Feldman, investment broker, are pre- sented below. Aug. Account Titles and Explanation

7 TO 12. PLEASE ANSWER.

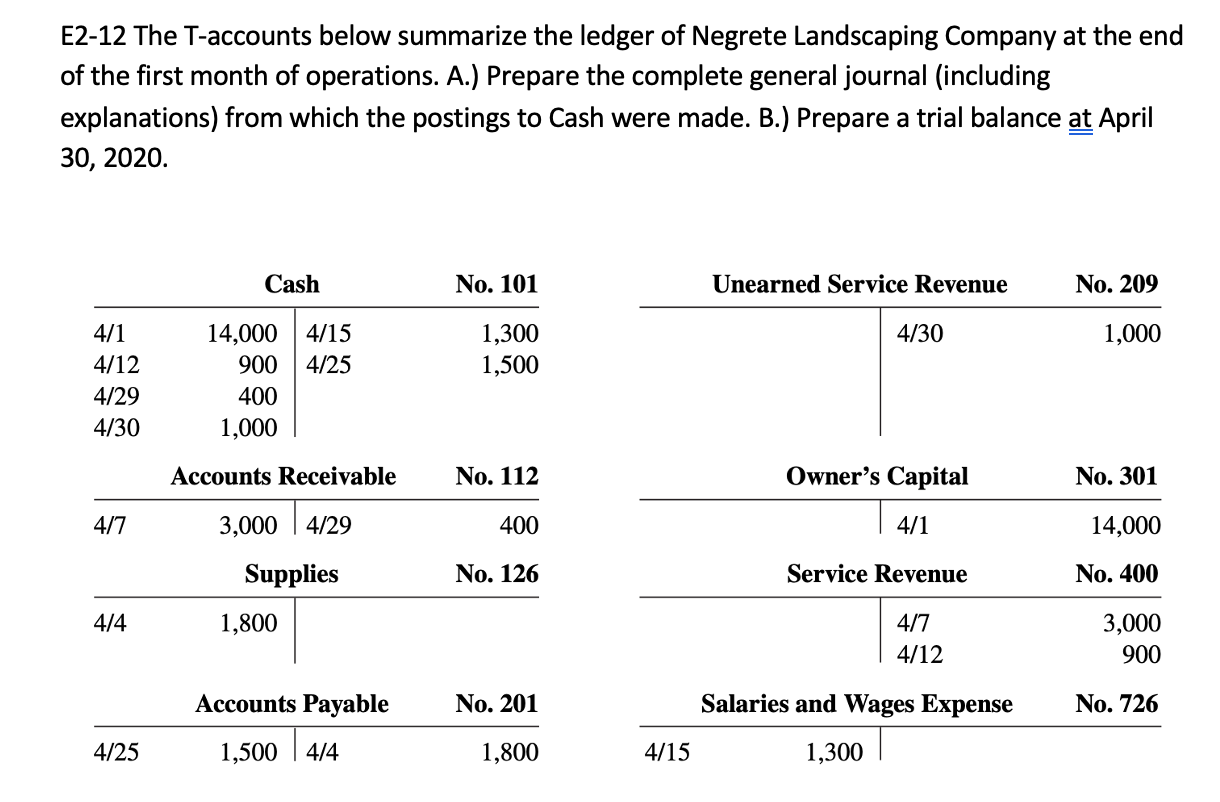

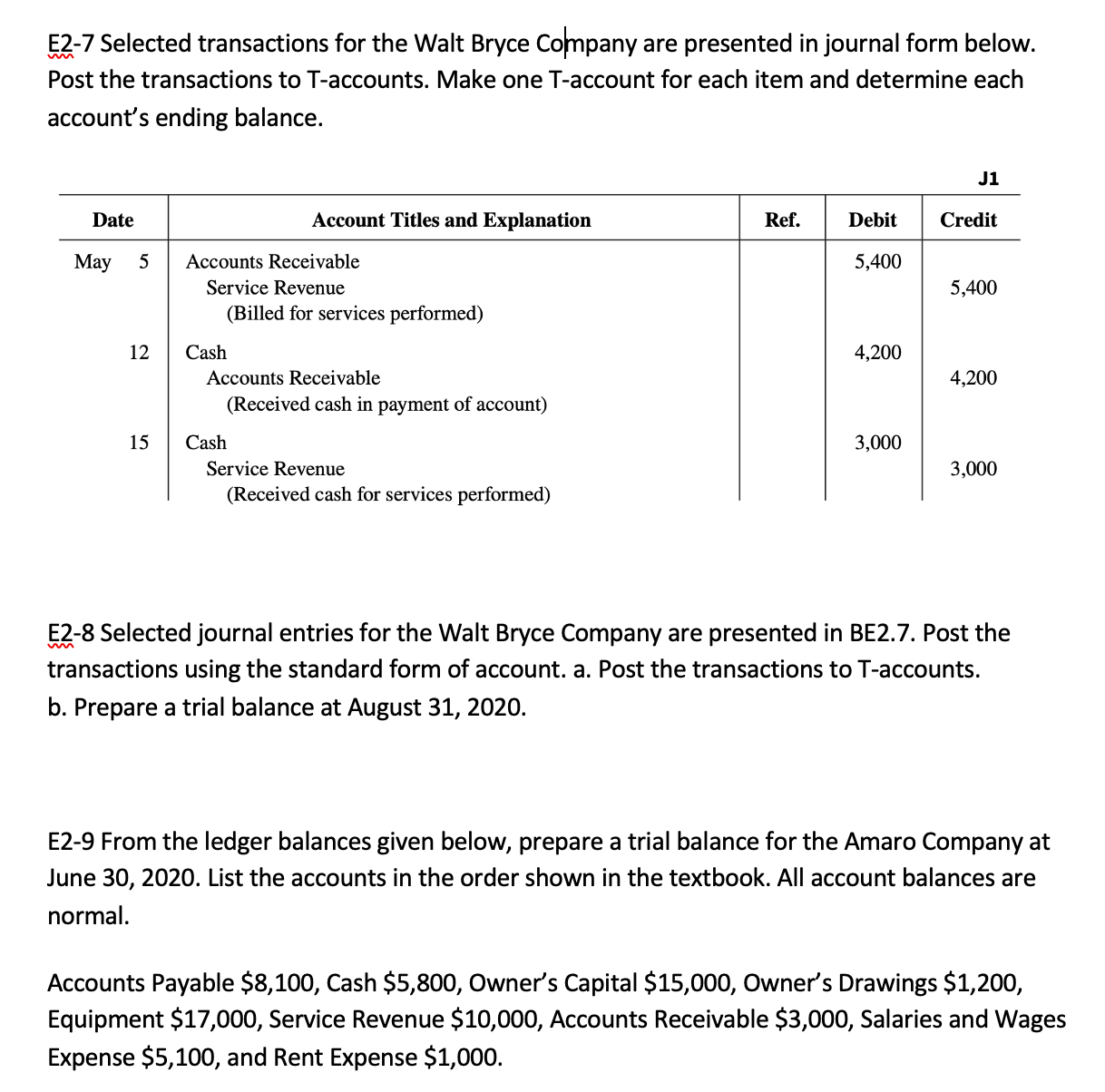

E2-11 Selected transactions from the journal of June Feldman, investment broker, are pre- sented below. Aug. Account Titles and Explanation 1 Cash Owner's Capital (Owner's investment of cash in business) 10 Cash Service Revenue (Received cash for services performed) 12 Equipment Cash Notes Payable (Purchased equipment for cash and notes payable) 25 Accounts Receivable Service Revenue (Billed clients for services performed) 31 Cash Accounts Receivable (Receipt of cash on account) 5,000 2,600 2,300 2,700 1,700 900 E2-12 The T-accounts below summarize the ledger of Negrete Landscaping Company at the end of the first month of operations. A.) Prepare the complete general journal (including explanations) from which the postings to Cash were made. B.) Prepare a trial balance g April 30, 2020. Cash No. 101 Unearned Service Revenue No. 209 411 14,000 4/15 1,300 480 1,000 4! 12 900 4l25 1,500 4129 400 4/30 1,000 Accounts Receivable No. 112 Owner's Capital No. 30] 4\" 3,000 4129 400 411 14,000 Supplies No. 126 Service Revenue No. 400 414 1,800 4!? 3,000 4/ 12 900 Accounts Payable No. 201 Salaries and Wages Expense N0. 726 405 1,500 | 4/4 1,800 4x15 1.300 E27 Selected transactions for the Walt Bryce Colnpany are presented in journal form below. Post the transactions to T-accounts. Make one T-accou nt for each item and determine each account' 5 ending balance. Date Account Titles and Explanation Ref. Debit Credit May 5 Accounts Receivable 5,400 Service Revenue 5,400 (Billed for services performed) 12 Cash 4,200 Accounts Receivable 4,200 (Received cash in payment of account) 15 Cash 3,000 Service Revenue 3,000 (Received cash for services performed) E333 Selected journal entries for the Walt Bryce Company are presented in BE2.7. Post the transactions using the standard form of account. a. Post the transactions to T-accounts. b. Prepare a trial balance at August 31, 2020. E2-9 From the ledger balances given below, prepare a trial balance for the Amaro Company at June 30, 2020. List the accounts in the order shown in the textbook. All account balances are normal. Accounts Payable $8,100, Cash $5,800, Owner's Capital $15,000, Owner's Drawings $1,200, Equipment $17,000, Service Revenue $10,000, Accounts Receivable $3,000, Salaries and Wages Expense $5,100, and Rent Expense $1,000