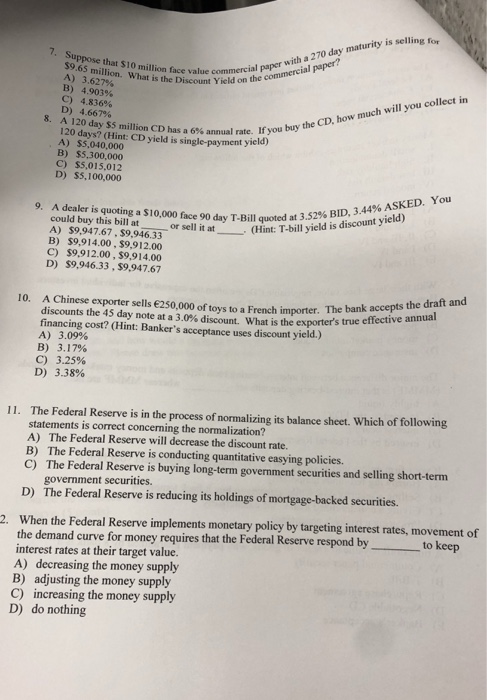

Question: 7 to 12 Suppose that s10 million face value commercithe comme What is the Discount Yield orn Discoune Commercial paper with a 270 day maturity

7 to 12

7 to 12 Suppose that s10 million face value commercithe comme What is the Discount Yield orn Discoune Commercial paper with a 270 day maturity is selling fo A) 3.627% B) 4.903% C) 4.836% D) 4.667% ngle- payment vi If you buy the CD, how much will you collect in A) $5,040,000 B) $5,300,000 C) $5,015,012 D) $5,100,000 or all 90day T-Billquoted at 3.52% BID, 3.44% ASKED. You or sell it at could buy this bill at A) $9,947.67, $9,946.33 B) $9,9 14.00. $9.9 12.00 C) $9,912.00, $9,914.00 D) $9,946.33, $9,947.67 S 9at (Hint: T-bill yield is discount yield) 947.67 10. A Chinese exporter sells 250,000 of toys discounts the 45 day note at a 30% discount to a French importer. The bank accepts the draft and what is the exporter's true effective annual financing cost? (Hint: Banker's acceptance uses discount yield.) A) 3.09% 3.17% 3.25% 3.38% B) C) D) The Federal Reserve is in the process of normalizing its balance sheet, which of following statements is correct concerning the normalization? A) The Federal Reserve will decrease the discount rate. B) The Federal Reserve is conducting quantitative easying policies. C) The Federal Reserve is buying long-term government securities and selling short-term 11 government securities. The Federal Reserve is reducing its holdings of mortgage-backed securities. D) When the Federal Reserve implements monetary policy by targeting interest rates, movement of the demand curve for money requires that the Federal Reserve respond by interest rates at their target value. A) decreasing the money supply B) adjusting the money supply C) increasing the money supply D) do nothing 2. uires that the Federal Reserve respond byto keep

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts