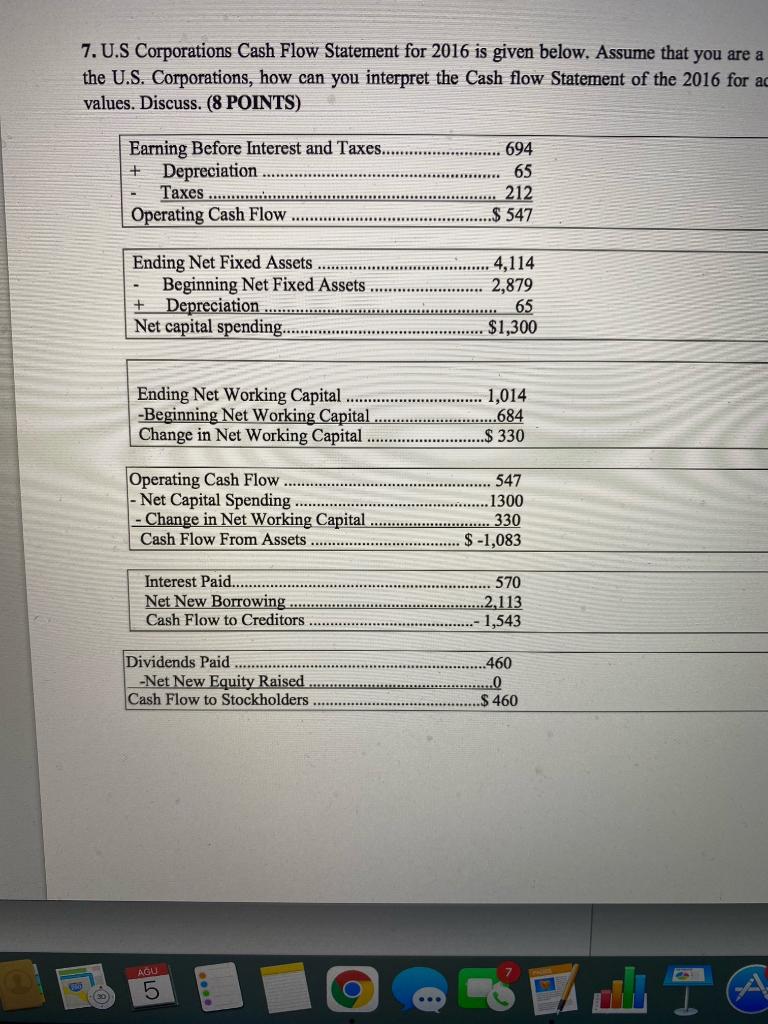

Question: 7. U.S Corporations Cash Flow Statement for 2016 is given below. Assume that you are a the U.S. Corporations, how can you interpret the Cash

7. U.S Corporations Cash Flow Statement for 2016 is given below. Assume that you are a the U.S. Corporations, how can you interpret the Cash flow Statement of the 2016 for a values. Discuss. (8 POINTS) Earning Before Interest and Taxes....... Depreciation + Taxes ....... 694 65 212 .$ 547 Operating Cash Flow Ending Net Fixed Assets Beginning Net Fixed Assets + Depreciation ...... Net capital spending.... 4,114 2,879 65 $1,300 Ending Net Working Capital -Beginning Net Working Capital Change in Net Working Capital 1,014 .684 $ 330 Operating Cash Flow ...... - Net Capital Spending ...... - Change in Net Working Capital. Cash Flow From Assets 547 .1300 330 $ -1,083 Interest Paid.. Net New Borrowing .......... Cash Flow to Creditors ...... 570 .2,113 1,543 Dividends Paid -Net New Equity Raised Cash Flow to Stockholders 460 10 .$ 460 AGU 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts