Question: 7. value: 11.11 points After completing a long and successful career as senior vice president for a large bank, you are preparing for retirement. After

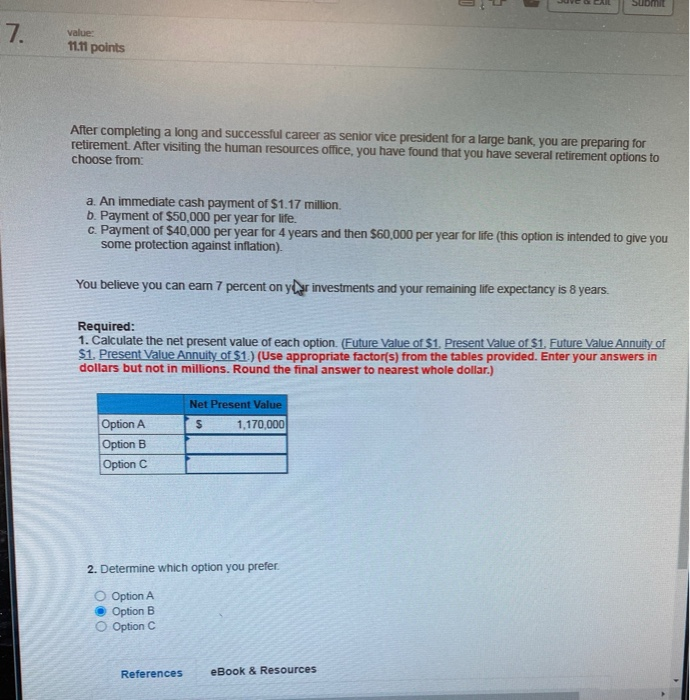

7. value: 11.11 points After completing a long and successful career as senior vice president for a large bank, you are preparing for retirement. After visiting the human resources office, you have found that you have several retirement options to choose from: a. An immediate cash payment of $1.17 million b. Payment of $50,000 per year for life. c. Payment of $40,000 per year for 4 years and then $60,000 per year for life (this option is intended to give you some protection against inflation). You believe you can eam 7 percent on your investments and your remaining life expectancy is 8 years. Required: 1. Calculate the net present value of each option. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Enter your answers in dollars but not in millions. Round the final answer to nearest whole dollar.) Net Present Value S 1,170,000 Option A Option B Option C 2. Determine which option you prefer. Option A Option B O Optionc References eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts