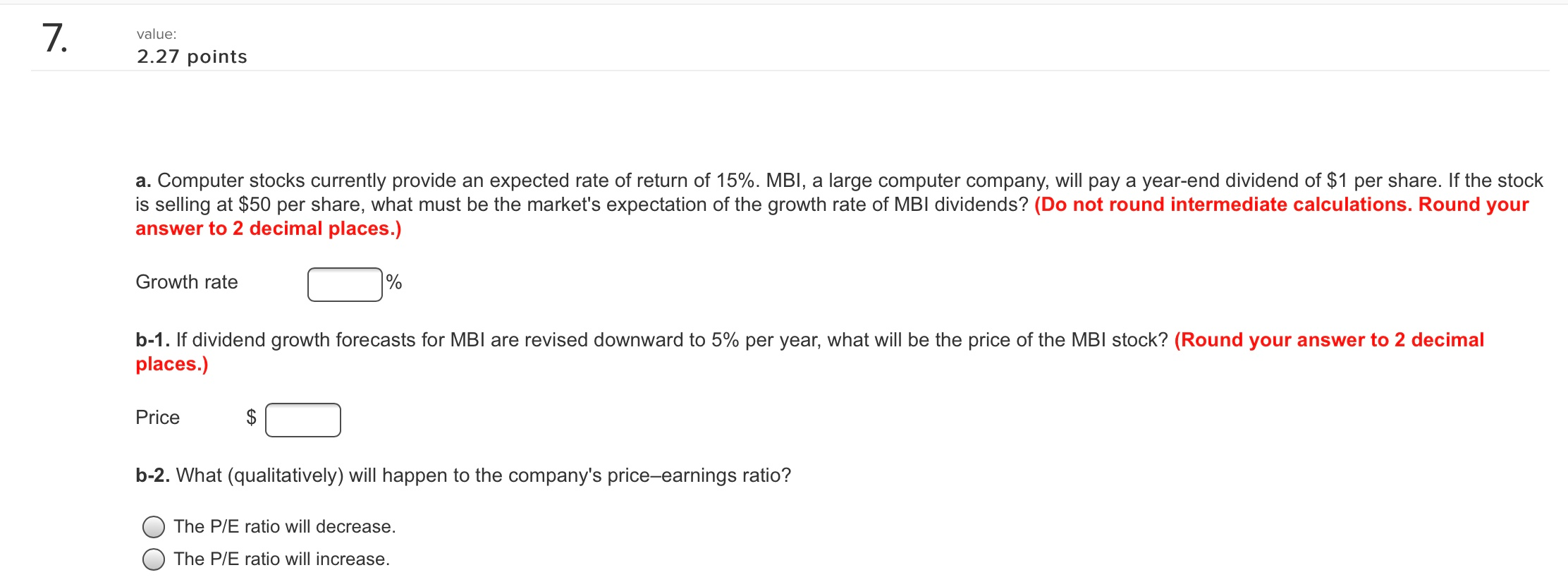

Question: 7. value: 2.27 points a. Computer stocks currently provide an expected rate of return of 15%. MBI, a large computer company, will pay a year-end

7. value: 2.27 points a. Computer stocks currently provide an expected rate of return of 15%. MBI, a large computer company, will pay a year-end dividend of $1 per share. If the stock is selling at $50 per share, what must be the market's expectation of the growth rate of MBI dividends? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Growth rate % b-1. If dividend growth forecasts for MBI are revised downward to 5% per year, what will be the price of the MBI stock? (Round your answer to 2 decimal places.) Price $ b-2. What (qualitatively) will happen to the company's price-earnings ratio? The P/E ratio will decrease. The P/E ratio will increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts