Question: 7. Value at risk measurement Suppose that the standard deviation of daily returns for a stock in the past quarter is 1.6 percent, and that

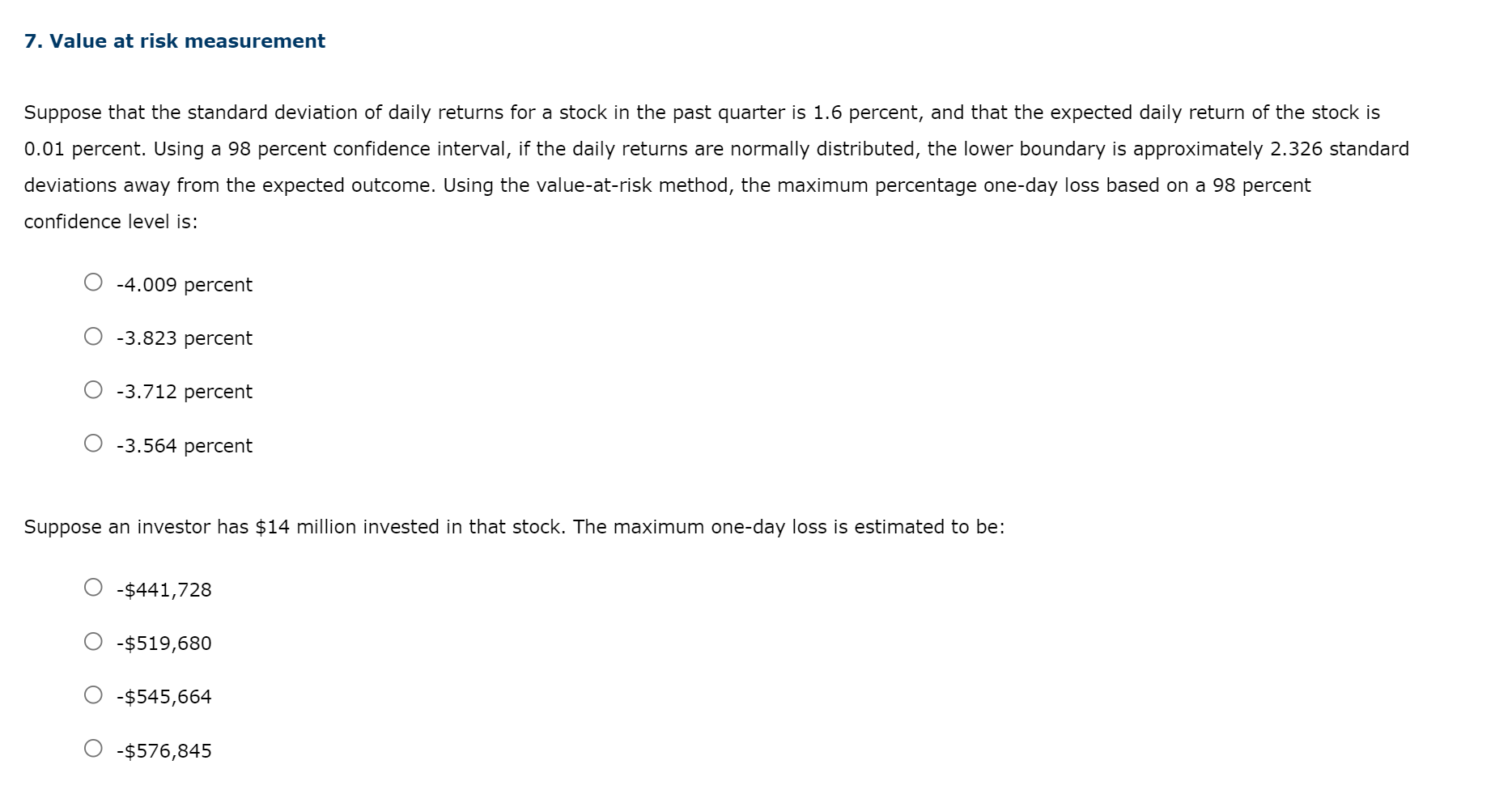

7. Value at risk measurement Suppose that the standard deviation of daily returns for a stock in the past quarter is 1.6 percent, and that the expected daily return of the stock is 0.01 percent. Using a 98 percent confidence interval, if the daily returns are normally distributed, the lower boundary is approximately 2.326 standard deviations away from the expected outcome. Using the value-at-risk method, the maximum percentage one-day loss based on a 98 percent confidence level is: -4.009 percent -3.823 percent -3.712 percent -3.564 percent Suppose an investor has $14 million invested in that stock. The maximum one-day loss is estimated to be: -$441,728 -$519,680 -$545,664 -$576,845

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts