Question: 7. What amount should be reported as total current liabilities?* SWEET TOOTH Company provided the following information for the current year: Increase in raw materials

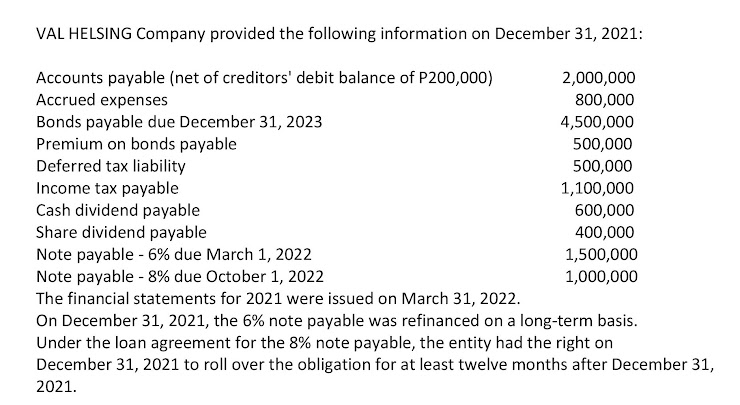

7. What amount should be reported as total current liabilities?*

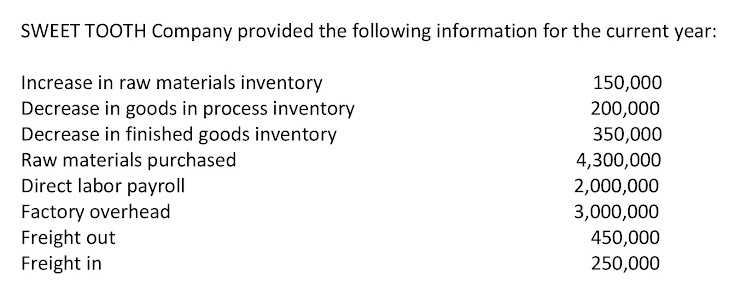

SWEET TOOTH Company provided the following information for the current year: Increase in raw materials inventory 150,000 Decrease in goods in process inventory 200,000 Decrease in finished goods inventory 350,000 Raw materials purchased 4,300,000 Direct labor payroll 2,000,000 Factory overhead 3,000,000 Freight out 450,000 Freight in 250,000VAL HELSING Company provided the following information on December 31, 2021: Accounts payable (net of creditors' debit balance of P200,000) 2,000,000 Accrued expenses 800,000 Bonds payable due December 31, 2023 4,500,000 Premium on bonds payable 500,000 Deferred tax liability 500,000 Income tax payable 1,100,000 Cash dividend payable 600,000 Share dividend payable 400,000 Note payable - 6% due March 1, 2022 1,500,000 Note payable - 8% due October 1, 2022 1,000,000 The financial statements for 2021 were issued on March 31, 2022. On December 31, 2021, the 6% note payable was refinanced on a long-term basis. Under the loan agreement for the 8% note payable, the entity had the right on December 31, 2021 to roll over the obligation for at least twelve months after December 31, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts