Question: 7. When projecting cash flows into the future, should the effects of inflation be considered? A. Yes, future cash flows should be adjusted to incorporate

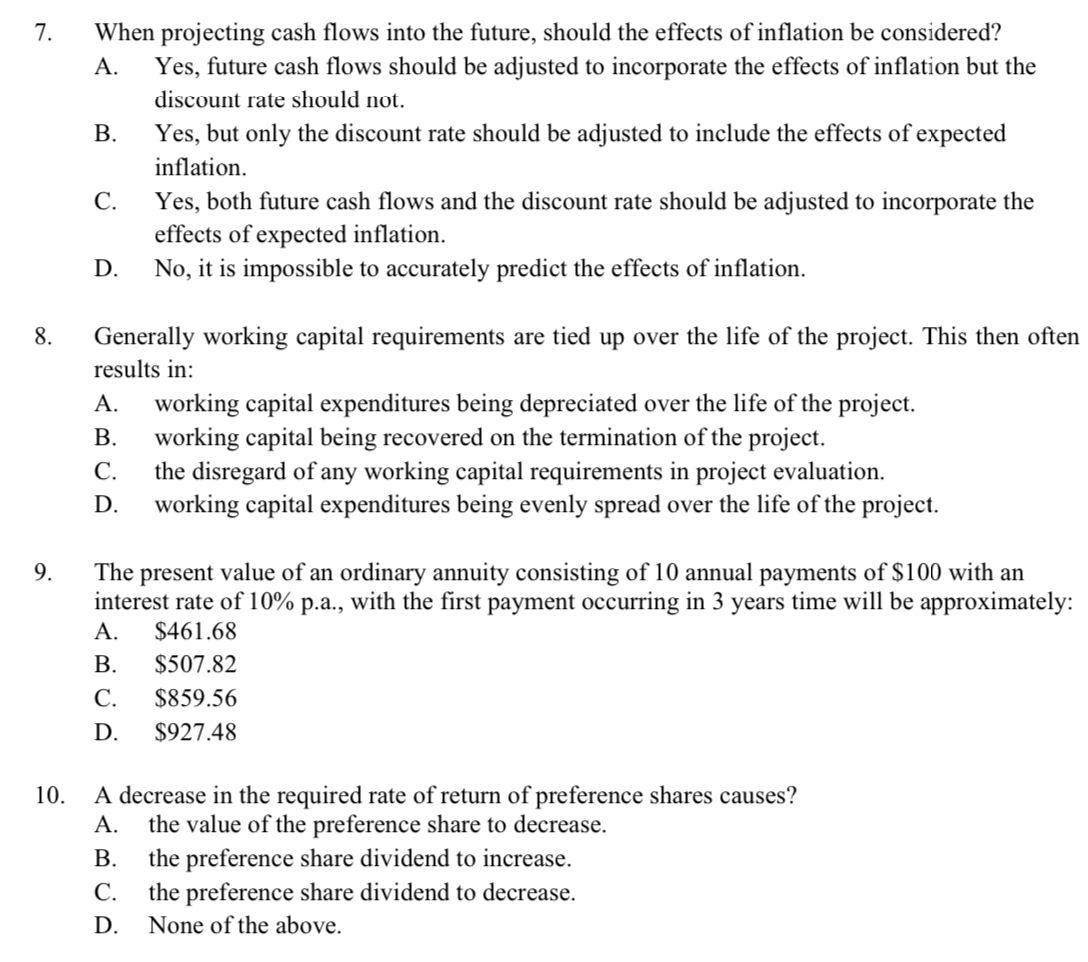

7. When projecting cash flows into the future, should the effects of inflation be considered? A. Yes, future cash flows should be adjusted to incorporate the effects of inflation but the discount rate should not. B. Yes, but only the discount rate should be adjusted to include the effects of expected inflation. C. Yes, both future cash flows and the discount rate should be adjusted to incorporate the effects of expected inflation. D. No, it is impossible to accurately predict the effects of inflation. 8. Generally working capital requirements are tied up over the life of the project. This then often results in: A. working capital expenditures being depreciated over the life of the project. B. working capital being recovered on the termination of the project. C. the disregard of any working capital requirements in project evaluation. D. working capital expenditures being evenly spread over the life of the project. 9. The present value of an ordinary annuity consisting of 10 annual payments of $100 with an interest rate of 10% p.a., with the first payment occurring in 3 years time will be approximately: A. $461.68 B. $507.82 C. $859.56 D. $927.48 10. A decrease in the required rate of return of preference shares causes? A. the value of the preference share to decrease. B. the preference share dividend to increase. C. the preference share dividend to decrease. D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts