Question: 7. Which answer best describes the difference between NPV and IRR? a. IRR is the interest rate that results in an NPV equal to zero

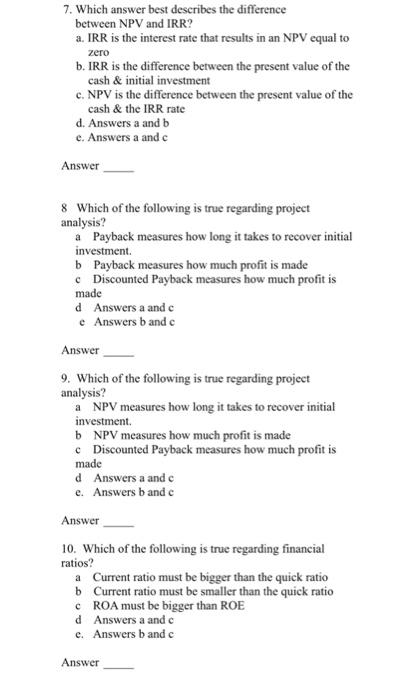

7. Which answer best describes the difference between NPV and IRR? a. IRR is the interest rate that results in an NPV equal to zero b. IRR is the difference between the present value of the cash & initial investment c. NPV is the difference between the present value of the cash & the IRR rate d. Answers a and be c. Answers a and c Answer 8 Which of the following is true regarding project analysis? a Payback measures how long it takes to recover initial investment b Payback measures how much profit is made c Discounted Payback measures how much profit is made d Answers a and c e Answers b and c Answer 9. Which of the following is true regarding project analysis? a NPV measures how long it takes to recover initial investment b NPV measures how much profit is made c Discounted Payback measures how much profit is made d Answers a and c e. Answers b and c Answer 10. Which of the following is true regarding financial ratios? a Current ratio must be bigger than the quick ratio b Current ratio must be smaller than the quick ratio CROA must be bigger than ROE d Answers a and c e. Answers band

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts