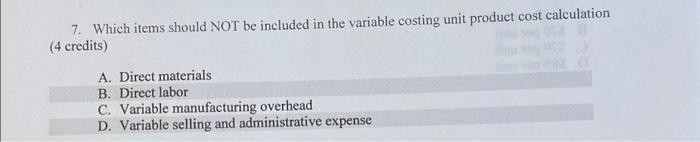

Question: 7. Which items should NOT be included in the variable costing unit product cost calculation ( 4 credits) A. Direct materials B. Direct labor C.

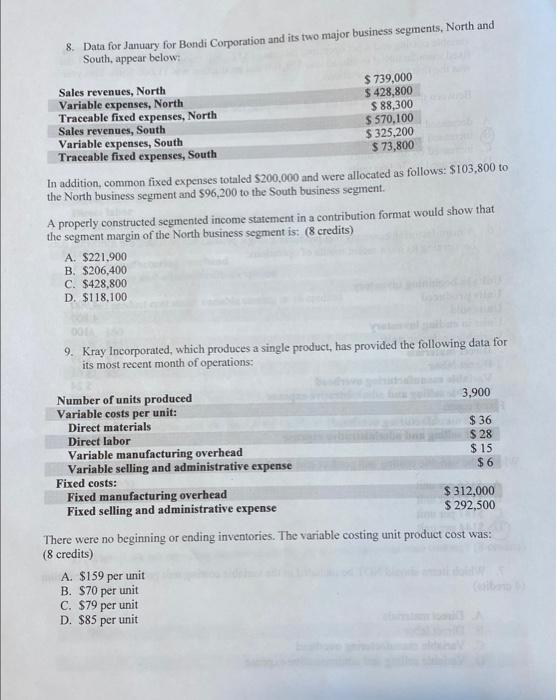

7. Which items should NOT be included in the variable costing unit product cost calculation ( 4 credits) A. Direct materials B. Direct labor C. Variable manufacturing overhead D. Variable selling and administrative expense 8. Data for January for Bondi Corporation and its two major business segments, North and South, appear below: In addition, common fixed expenses totaled $200.000 and were allocated as follows: $103,800 to the North business segment and $96,200 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the North business segment is: ( 8 credits) A. $221,900 B. $206,400 C. $428,800 D. $118,100 9. Kray Incorporated, which produces a single product, has provided the following data for its most recent month of operations: There were no beginning or ending inventories. The variable costing unit product cost was: ( 8 credits) A. $159 per unit B. $70 per unit C. $79 per unit D. $85 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts