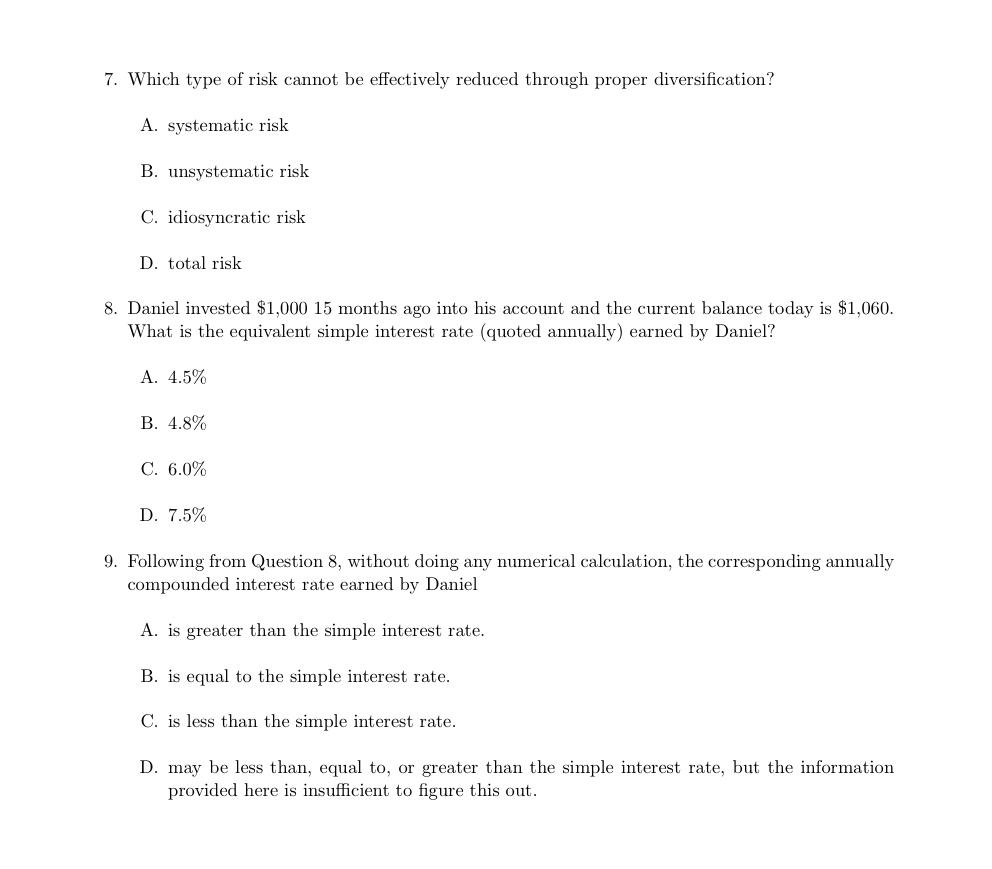

Question: 7. Which type of risk cannot be effectively reduced through proper diversification? A. systematic risk B. unsystematic risk C. idiosyncratic risk D. total risk 8.

7. Which type of risk cannot be effectively reduced through proper diversification? A. systematic risk B. unsystematic risk C. idiosyncratic risk D. total risk 8. Daniel invested $1,00015 months ago into his account and the current balance today is $1,060. What is the equivalent simple interest rate (quoted annually) earned by Daniel? A. 4.5% B. 4.8% C. 6.0% D. 7.5% 9. Following from Question 8, without doing any numerical calculation, the corresponding annually compounded interest rate earned by Daniel A. is greater than the simple interest rate. B. is equal to the simple interest rate. C. is less than the simple interest rate. D. may be less than, equal to, or greater than the simple interest rate, but the information provided here is insufficient to figure this out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts