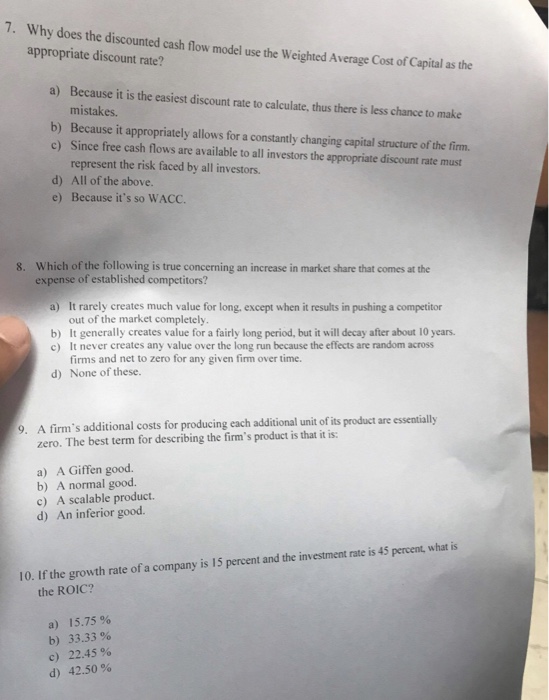

Question: 7. Why does the discounted cash flow model use the Weighted Average Cost of Capital as the appropriate discount rate? a) Because it is the

7. Why does the discounted cash flow model use the Weighted Average Cost of Capital as the appropriate discount rate? a) Because it is the easiest discount rate to calculate, thus there is less chance to make mistakes. b) Because it appropriately allows for a constantly changing capital structure of the firm c) Since free cash flows are available to all investors the appropriate discount rate must represent the risk faced by all investors. d) All of the above. e) Because it's so WACC Which of the following is true concerning an increase in market share that comes at the expense of established competitors? 8. a) It rarely creates much value for long, except when it results in pushing a competitor out of the market completely It generally creates value for a fairly long period, but it will decay after about 10 years. It never creates any value over the long run because the effects are random across firms and net to zero for any given firm over time. b) c) d) None of these. A firm's additional costs for producing each additional unit of its product are essentially zero. The best term for describing the firm's product is that it is 9. a) A Giffen good. b) A normal good. c) A scalable product. d) An inferior good. 10. If the growth rate of a company is 15 percent and the investment rate is 45 percent, what is the ROIC? a) 15.75 % b) 33.33% c) 22.45% d) 42.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts